India is on the cusp of a renewable revolution, and at the heart of this transformation lies Solar Smart Energy India. With one of the world’s fastest-growing energy markets, India faces the dual challenge of meeting rising electricity demands while ensuring sustainability. Solar energy, already a critical pillar of India’s renewable journey, is now evolving into smart solar energy—an integration of digital technologies, AI, IoT, and advanced grid systems that make solar more efficient, reliable, and adaptable.

Table of Contents

The push for Solar Smart Energy in India isn’t just about generating clean electricity; it’s about creating a smart ecosystem that empowers households, industries, and entire cities to manage energy intelligently. With the government aiming for 500 GW of renewable energy capacity by 2030, of which solar will play a dominant role, India’s solar story is moving from traditional panels to intelligent, data-driven systems.

What is Solar Smart Energy?

Solar Smart Energy in India is the next generation of renewable power that combines traditional solar energy with advanced technologies like IoT (Internet of Things), AI (Artificial Intelligence), energy storage, and smart grids. It transforms solar power from being just a clean energy source into a smart, reliable, and efficient energy management system.

Unlike conventional solar systems that simply generate electricity, Solar Smart Energy in India enables:

- Real-time monitoring of solar generation and consumption.

- Smart storage solutions to use excess power during nights or peak demand hours.

- AI-based forecasting to predict energy needs and weather patterns.

- Grid integration with net metering, allowing users to sell surplus electricity back to the grid.

- Predictive maintenance that ensures higher efficiency and longer system life.

Why It Matters for India

India is on an ambitious journey to achieve 500 GW of renewable energy by 2030, and Solar Smart Energy plays a vital role by:

- Reducing dependence on fossil fuels.

- Providing cost-effective power for industries and households.

- Supporting sustainable development goals (SDGs).

- Helping India meet its net-zero emissions target by 2070.

Solar Smart Energy in India: Current Landscape

India’s solar story has moved fast — from early pilot projects a decade ago to the backbone of the country’s renewable rollout today. The landscape in 2024–2025 is defined by three simultaneous shifts: rapid capacity additions, aggressive domestic manufacturing and policy support, and the early commercialization of integrated solar + storage (which turns variable solar into firm, dispatchable power). For corporate energy buyers and industrial leaders, these shifts change the economics and strategy of power procurement forever.

1) Scale today — the numbers that matter

India’s cumulative solar capacity (utility + rooftop + hybrid) crossed the 100 GW mark and, as of July 31, 2025, the MNRE reports ~119.02 GW of solar power installed, including roughly 90.99 GW of ground-mounted and 19.88 GW of grid-connected rooftop solar. This scale is transforming both grid dynamics and corporate purchasing options.

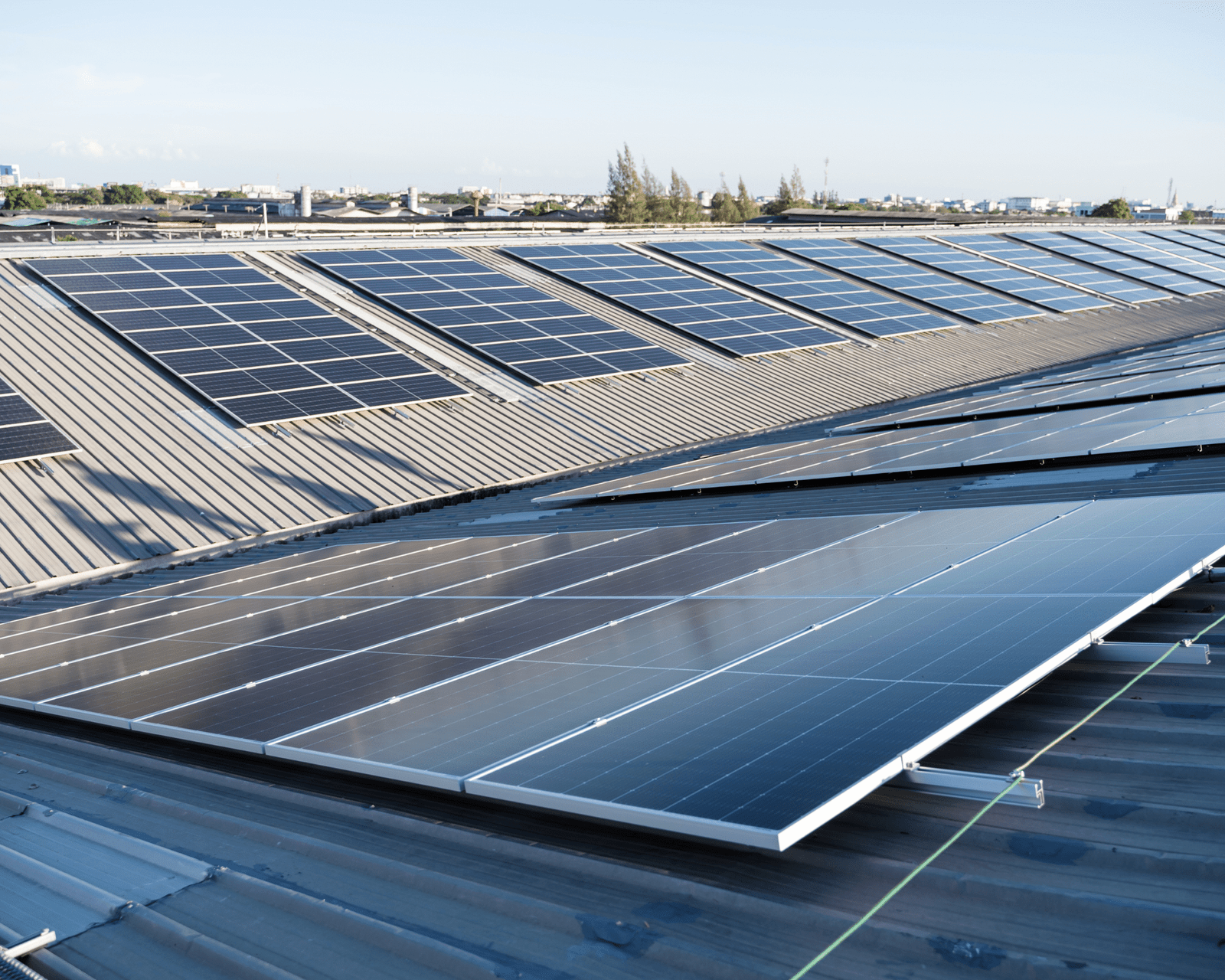

Rooftop adoption is accelerating too — H1 2025 saw a jump in rooftop installations compared with H1 2024, with industry trackers reporting multi-GW additions and an expanding distributed-solar market that’s increasingly attractive to manufacturing campuses.

2) Cost trajectory: solar and solar+storage are now highly competitive

The cost trajectory of solar smart energy has reached unprecedented levels of competitiveness. Solar auction tariffs in India remain extremely low, with record bids dipping into the low ₹2–₹3 per kWh range for utility-scale solar. Bundled solar+storage auctions are also discovering competitive “pack” prices. In 2024, the lowest tariffs were around ₹2.15/kWh, while recent solar+4-hour storage tenders produced discovered tariffs near ₹3.3/kWh (pack). These levels make solar smart energy, providing 24×7 clean power, a commercially viable alternative to conventional thermal power for many industrial contracts. Such price signals are reshaping long-term corporate power procurement strategies.

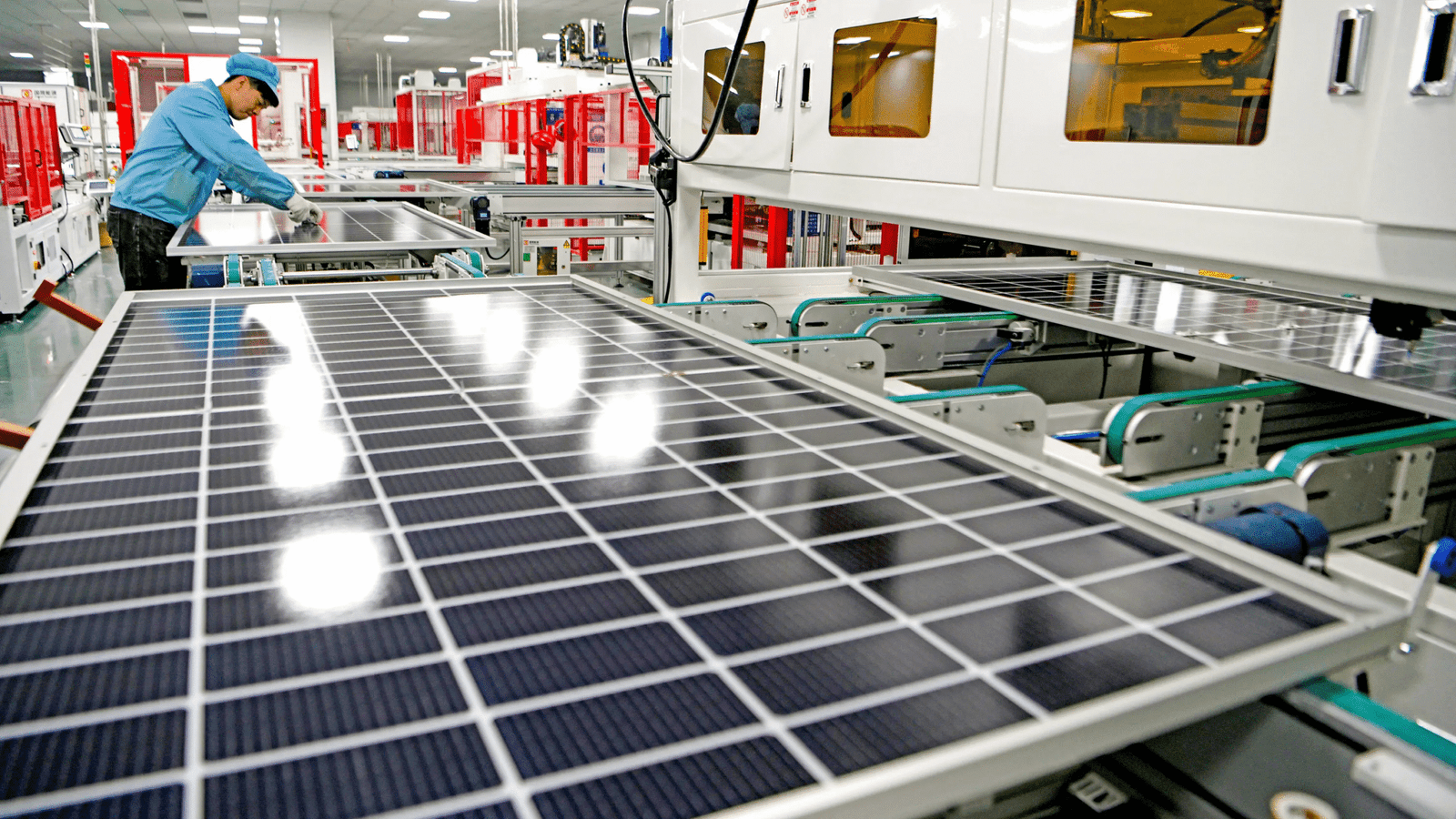

3) Domestic manufacturing: PLI is reshaping supply chains

India’s Production Linked Incentive (PLI) schemes and industrial policies have driven a steep increase in domestic PV manufacturing capacity. Recent reports indicate that module manufacturing capacity is expanding rapidly, with significant new lines announced under the PLI program. For businesses, this growth in domestic manufacturing enhances the security of solar smart energy supply, shortens lead times, and reduces exposure to global trade uncertainties, making industrial adoption smoother and more predictable.

4) Storage: still early but scaling quickly

Battery Energy Storage System (BESS) deployment in India is accelerating from a modest base. Installations grew from a few dozen MWh in 2022–2023 to several hundred MWh in 2024, with large GWh-scale pipelines tied to solar projects underway. While grid integration and implementation speed remain challenges, storage is clearly moving from pilot stages to mainstream adoption. When paired with PV, solar smart energy solutions with storage deliver firm, dispatchable power for industrial users, unlocking the full potential of renewable energy.

5) Policy & market enablers — a favourable regulatory ecosystem

Corporate buyers benefit from a favourable regulatory ecosystem that supports solar smart energy deployment. Key policy instruments include Renewable Purchase Obligations (RPOs), net-metering, open-access regulations for captive procurement, accelerated depreciation, and state-level hybrid park and RTC renewable tenders. The combination of central and state-level support creates multiple pathways for manufacturers to design customized solar smart energy solutions that meet both operational and sustainability objectives.

6) Emerging product-market fit: from captive roofs to RTC PPAs

The industrial adoption of solar smart energy has evolved far beyond rooftop installations. Today, businesses can choose from captive rooftops, ground-mounted farms, open-access PPAs, corporate offtake via SECI/state auctions, and solar+storage bundles capable of delivering firm, multi-hour power. These options allow manufacturers to reduce energy costs, lock in predictable tariffs, minimize carbon footprints, and improve resilience against grid outages and fossil fuel price volatility.

7) Technology & system intelligence — the “smart” in Solar Smart Energy

Solar smart energy is not just about panels and inverters—it’s about intelligent, digitally enabled systems. IoT monitoring, AI-driven performance analytics, advanced O&M, demand-side scheduling, and grid-interactive storage dispatch all combine to maximize yield, minimize downtime, and make energy predictable and manageable. Factories adopting solar smart energy can even participate in energy markets, selling surplus power or providing ancillary services, turning intermittent solar generation into a reliable business asset.

8) Challenges on the horizon (and how industry can mitigate them)

- Transmission & curtailment risk: With rapid capacity additions, grid expansion and flexibility lag in places — requiring careful siting and grid studies. (MNRE and state utilities are actively addressing these.)

- Storage rollout pace vs. pipeline: Large BESS pipelines exist, but a minority are operational today; execution and supply-chain hurdles remain. Contractors and offtakers should stress-test timelines and include performance milestones.

- Quality control & warranties: Rapid local manufacturing means variable supplier quality; rigorous procurement specs and EPC oversight are essential.

- Policy heterogeneity across states: Rules for net metering, open access, and interconnection vary — legal and regulatory diligence is required before project rollout.

9) Opportunities for manufacturers & decision-makers — what to act on now

- Capitalize on captive rooftops & brownfield land: immediate OPEX reductions and fast paybacks.

- Consider bundled solar + storage PPAs for resiliency and for meeting internal sustainability targets with firm power.

- Leverage PLI and local supply chains to de-risk procurement and shorten project lead times.

- Deploy smart O&M & analytics to maximize yield and extend asset life; this improves ROI and reduces unplanned downtime.

10) Near-term outlook (12–36 months) — what to expect

Expect continued robust capacity additions in solar smart energy, with a growing share of rooftop and distributed solar projects. More tenders are now combining storage with solar, and domestic module and cell manufacturing under PLI will continue to scale rapidly. Operational BESS capacity is set to increase from today’s hundreds of MWh to multiple GWh as projects move from award to commissioning, unlocking truly firm and reliable solar smart energy solutions for industrial consumers over the next 2–3 years.

Key Benefits of Solar Smart Energy in India

The adoption of Solar Smart Energy India brings several transformative advantages:

1. Cost Savings

Solar smart energy offers an economically compelling solution for industries, with tariffs ranging from ₹2.5 to ₹3 per unit, often making it cheaper than coal or conventional grid power. Some recent auctions have even recorded tariffs as low as ₹2.15/kWh. Rooftop solar smart energy systems typically deliver a return on investment (ROI) within 3–5 years, providing nearly free electricity for over two decades. The inherent price stability of sunlight, unlike volatile fossil fuel markets, is further enhanced through Power Purchase Agreements (PPAs), which allow industries to lock in predictable tariffs for 15–25 years. By adopting solar smart energy, manufacturers can reduce energy bills by 30–50%, directly enhancing their global competitiveness.

2. Energy Security & Independence

India’s heavy reliance on imported crude oil and coal—over 85% for crude oil—can be significantly mitigated through solar smart energy. When paired with Battery Energy Storage Systems (BESS), solar smart energy provides a continuous, round-the-clock power supply, ensuring uninterrupted industrial operations even during grid outages. This reduces dependency on expensive diesel generators, lowers operational expenditures (OPEX), and decreases carbon emissions. For industries, it translates into minimal production downtime and enhanced operational reliability.

3. Sustainability & ESG Leadership

A 1 megawatt (MW) solar plant offers significant environmental benefits by offsetting over 1,200 tons of carbon dioxide (CO₂) annually, which is equivalent to planting 20,000 trees. This initiative aligns with global Net Zero targets and facilitates Scope 2 emission reductions. Additionally, it enhances Environmental, Social, and Governance (ESG) scores, attracts sustainability-minded investors, and assists in meeting the supply-chain requirements of international brands.

4. Carbon Footprint Reduction

Smart energy solutions extend beyond solar panels, incorporating the Internet of Things (IoT), Artificial Intelligence (AI), and analytics. These technologies enable real-time monitoring for maximized plant efficiency and predictive maintenance to minimize downtime. Smart load shifting optimizes production by aligning it with periods of inexpensive solar energy. Additionally, surplus energy can be returned to the grid via net metering.

5. Government Support & Incentives

The Indian government actively supports the solar energy sector through a multifaceted approach, including: Accelerated Depreciation at 40%, which reduces taxable income; GST benefits, offering lower tax rates on solar components; and the facilitation of Renewable Purchase Obligations (RPOs) through in-house solar installations. Additionally, policies like Open Access and Net Metering enable businesses to source or sell power across the grid. The Production Linked Incentive (PLI) scheme further bolsters this support by promoting local manufacturing and improving supply-chain reliability.

Technologies Driving Solar Smart Energy in India

| Technology | What It Does / How It Helps | Recent Developments / Examples in India | What Industries Should Consider |

|---|---|---|---|

| 1. Artificial Intelligence (AI) & Machine Learning (ML) | • Forecasting solar output (weather, irradiance) • Predictive maintenance (detecting module faults, inverter issues) • Dynamic optimization of system performance (adjusting to environmental conditions) | • AI-forecasting models in Gujarat reduced gap between predicted & actual output by ~30%. • In Madhya Pradesh, smart solar parks integrating AI + IoT to detect underperforming panels, optimize O&M. • AI used in solar trackers / controllers to adjust angles based on sun position & cloud cover. | • Use AI/ML especially in large installations to: reduce downtime, improve yield, anticipate issues before they become big, optimize maintenance scheduling, and improve forecasting for better grid/investor confidence. |

| 2. Smart Inverters & Power Electronics | • Convert DC → AC with high efficiency • Handle grid integration challenges (voltage fluctuations, reactive power) • Hybrid inverter designs that support solar + storage • Microinverters or string inverters for panel-level optimization (especially useful for shading, uneven conditions) | • Indian solar sites are increasingly using inverters with real-time monitoring & diagnostics. • Innovations in inverter systems that tie in with storage and grid-interactive features are reported. | • For industrial deployments: ensure inverter choices support hybrid systems, have good efficiency, fault detection, good warranty, and capacity to handle reactive power/grid requirements in your region. |

| 3. IoT, Real-Time Monitoring & Digital Analytics | • Sensors to monitor panel temperature, performance, shading, soiling, etc. • Smart meters and edge computing for local data → faster response times • Data platforms that allow centralized tracking of many sites, alerts, dashboards | • Solar parks in MP are using IoT + AI to monitor in real time and detect panel faults, shading or dirt issues. • Systems reported in Indian case studies where real-time monitoring + predictive maintenance boosted output and reduced downtime. | • Key for large scale or distributed systems. Helps reduce operational expenses, improves reliability, and provides transparency (useful for ESG and investors). |

| 4. Solar + Storage Integration | • Batteries allow storage of excess solar generation so energy can be used during peak loads or at night • Improves reliability and resilience (backup power, smooth evening ramp • Helps reduce curtailment and better alignment of generation with demand | • Model village in Modhera, Gujarat uses rooftop + carport solar + a 15 MWh battery storage system to ensure 24/7 supply. • Increased policy push & auctions in solar + storage projects in several Indian states. (Storage is becoming part of tenders more commonly.) | • For manufacturers: if continuous operations are needed, or electricity costs are high during peak hours or grid reliability is a concern, pairing solar with storage is increasingly becoming not just nice, but essential. Need to evaluate battery type, lifecycle, charging/discharging strategy. |

| 5. Smart Solar Parks / Hybrid Systems | • Large utility or industrial solar parks using multiple technologies: trackers, high-efficiency panels, storage, digital monitoring • Hybrid systems mixing solar + wind or solar + storage for better utilization • Use of trackers to follow sun, or bifacial modules to capture reflected light | • Smart solar park initiatives are being developed in Madhya Pradesh that integrate AI + IoT + predictive analytics to scale efficiently. • Real-time performance enhancement via trackers and bifacial panels mentioned in inverter tech improvements. | • In large capacity projects, it pays off to use these hybrid and smart park technologies to maximize yield, reduce losses, and better manage cost per kWh. Also helps spread fixed costs over more output. |

| 6. Advanced Photovoltaic (PV) Materials & Module Technologies | • Bifacial panels • Higher efficiency cell technologies (TOPCon, PERC, etc.) • Better encapsulation, reduced degradation • Lightweight / flexible modules, new materials like perovskites (still emerging) | • Reports in Indian solar-tech media about advanced modules and module-level innovations. • Emphasis in monitoring real-time module performance and minimizing losses so better modules help in reducing performance degradation. | • For industries, module efficiency directly impacts land/roof use, installation cost, and lifetime return. Specifying higher efficiency and proven degradation performance matters especially in harsh climates. |

| 7. Drone / Automation / Robotics in O&M | • Drones for thermal imaging, visual inspections, hotspot detection • Robotic cleaning of panels (especially in dusty/arid areas) • Automation of routine checks, reducing manual labour & faster identification of faults | • Use of AI-powered drones & thermographic inspections in Indian solar plants to detect hotspots, module issues early. • Smart solar parks where O&M is increasingly automated due to scale. | • Very useful for large parks or remote/harsh locations. Less labor risk, faster response. Impacts performance, reduces downtime and cleaning costs. |

| 8. Grid-Interactive Technologies & Smart Grid / Virtual Power Plants (VPPs) | • Smart inverters, demand response, reactive power management • Virtual Power Plants aggregating distributed solar + storage + demand response • Blockchain / peer-to-peer energy trading in some pilots • Better forecasting & load balancing to reduce curtailment or overproduction | • Some reports on pilot projects of P2P solar trading and blockchain in India. • Smart solar parks also interacting with grid to manage supply‐demand and curtailment issues. • Model village projects (e.g. Modhera) showing how integrated systems feed excess solar to grid and use stored energy when needed. | • Important in states where grid reliability is variable, or where policies allow open access or feeding back to grid. For industries, participation in VPPs or selling surplus can become an additional revenue source. |

Solar Smart Energy India – Challenges

1. Transmission & Grid Constraints

One of the biggest barriers to solar expansion in India is insufficient transmission infrastructure. In states like Rajasthan and Gujarat, where solar potential is highest, delays in building new substations and transmission corridors have led to curtailment of generated power — in some cases, up to 25% of solar output goes wasted. For industries investing in solar through open access or captive models, this means lower utilization of installed capacity and financial losses. Strengthening the grid and speeding up transmission projects is critical for long-term reliability.

2. High Upfront Costs & Storage Economics

While solar costs have dropped significantly, solar + storage systems — essential for round-the-clock reliability — remain expensive. Adding batteries can increase the total system cost by 40–70%. Lithium-ion and advanced batteries are still not cost-effective at scale for many industrial users, making payback periods longer. For manufacturing units that run 24×7, the economics of solar can be challenging without government incentives or innovative financing.

3. Policy & Regulatory Uncertainty

India’s solar policies are ambitious, but they vary widely by state and are subject to frequent changes. Rules around net metering, open access charges, wheeling charges, and approved lists of models (ALMM) shift often, leaving investors and industries uncertain. For a business making long-term energy decisions, this lack of stability creates hesitation. What looks profitable today could change tomorrow with a new tariff order.

4. Financing & Discom Risks

The cost of capital in India is relatively high compared to developed markets, raising project costs. While CAPEX projects offer high ROI, many industries prefer OPEX/PPA models, but these depend on financing and bankability. Additionally, financially stressed Discoms (distribution companies) often delay payments or attempt to renegotiate power purchase agreements (PPAs). This creates revenue risk for solar developers and indirectly impacts industrial buyers of solar power.

Government Policies and Subsidies Supporting Smart Solar in India

1. Production Linked Incentive (PLI) Scheme for High

The initiative aims to establish gigawatt (GW)-scale domestic manufacturing capacity for high-efficiency solar photovoltaic (PV) modules. This undertaking is designed to diminish reliance on imported solar hardware, enhance the efficiency of solar modules, and fortify the national solar hardware industry. The second tranche of the scheme allocates ₹19,500 crore to support approximately 39,600 megawatts (MW) of manufacturing capacity distributed among various manufacturers. Financial disbursements are scheduled over a five-year period subsequent to the commissioning of these manufacturing plants. Anticipated key outcomes include a significant expansion of domestic module production, the creation of hundreds of thousands of direct and indirect jobs, an improvement in the overall quality of solar modules, and the development of export capabilities.

2. Approved List of Models & Manufacturers (ALMM)

The Approved List of Models and Manufacturers (ALMM) is a government regulation that designates specific solar modules, and eventually solar cells and wafers from approved sources, as eligible for government-tied projects, net-metering, open access, and other subsidy-linked initiatives. Beginning June 1, 2026, projects within these categories must utilize modules containing solar cells listed under ALMM List-II, with exemptions available for projects bid prior to relevant deadlines.

A proposed amendment seeks to extend ALMM to include solar wafers from June 1, 2028, thereby covering the upstream supply chain, encompassing modules, cells, and wafers under domestic verification processes. The government has implemented easing measures, such as providing grace periods after list publications and offering exemptions for certain project categories or bids submitted by specified dates, to facilitate compliance and mitigate abrupt market impacts.

3. Tax, GST & Import/Custom Duty Adjustments

The government has reduced the Goods and Services Tax (GST) on solar modules and certain solar equipment to decrease capital expenditure (CAPEX) for industry adopters. While various tax and duty policies affecting solar equipment are subject to change, modules and associated goods receive preferential treatment under specific schemes. Import duties and restrictions, especially for components that are not manufactured domestically or do not comply with domestic content or approved list requirements, are implemented to foster backward integration and promote domestic manufacturing. The Approved List of Manufacturers and Models (ALMM) and Production Linked Incentives (PLI) schemes are instrumental in supporting these objectives.

4. Policy Support for Net-Metering, Open Access & Captive / Behind-the-Meter Solar

Many states offer net metering or net-billing, a policy that credits customers for excess solar power exported to the grid, thereby improving the financial viability of solar and storage systems, particularly rooftop installations. Open access policies permit large industrial and commercial users to purchase solar power from offsite solar farms or collective solar projects through Power Purchase Agreements (PPAs), offering an alternative to solely relying on grid electricity and providing flexibility for sourcing more affordable and cleaner energy. While behind-the-meter installations, where onsite generation is used for self-consumption, are increasingly supported through subsidy and tender programs, their implementation varies across different states.

Future of Solar Smart Energy in India

India’s solar smart energy sector is poised for significant growth, driven by ambitious renewable energy targets and technological advancements. By 2030, the country aims for 500 GW of non-fossil fuel capacity, with solar expected to contribute substantially, reaching 280–320 GW and positioning India as a global leader. This expansion offers industries access to reliable, affordable, and cleaner energy, reducing dependency on volatile fossil fuel markets and enhancing operational stability.

Key trends shaping this future include the rise of solar-plus-storage solutions, which are crucial for ensuring round-the-clock power availability and grid stability as solar penetration increases. Falling battery costs and hybrid projects are expected to accelerate this transformation. Technological integration of artificial intelligence, IoT, and data-driven systems will lead to smarter, more efficient solar operations through predictive maintenance and real-time monitoring, while smart grids will enable dynamic energy trading.

India is also prioritizing self-reliance in solar manufacturing through initiatives like the Production Linked Incentive (PLI) scheme, aiming for substantial domestic module and cell manufacturing capacity by 2030. This will reduce import reliance and secure the supply chain. For energy-intensive sectors, adopting solar smart energy can cut energy costs by 30–50% through captive plants, open access, or rooftop installations, simultaneously strengthening ESG credentials and enhancing competitiveness in green export markets.

Government policies, including net metering, open access reforms, tax benefits, and accelerated depreciation, are making solar adoption financially attractive. Furthermore, frameworks for carbon credits, green financing, and mandates for storage and smart meters will accelerate the transition. Ultimately, investing in solar smart energy offers Indian industries a strategic imperative for long-term growth, providing lower costs, stronger compliance, and a competitive edge in global markets.

Why Businesses Should Invest in Solar Smart Energy Now

Businesses in India are increasingly adopting solar smart energy to combat rising electricity costs, unpredictable tariffs, and sustainability demands. Market-driven and technological advantages, including significantly reduced solar power costs, make it cheaper than grid electricity, offering predictable long-term pricing and insulation from volatility. Solar investments provide rapid paybacks (3-5 years) and long-term savings, enhancing financial stability. Coupled with storage, solar ensures operational resilience against grid outages. Modern technologies like smart grids and AI optimize performance, while sustainability credentials and ESG performance improve brand reputation and open green export opportunities, creating a competitive advantage.

Conclusion

Solar smart energy is no longer a distant vision—it’s today’s most strategic business decision. For industries navigating rising energy costs, global competition, and the demand for sustainable practices, solar provides a clear path forward. It delivers measurable cost savings, shields operations from power uncertainties, and unlocks new opportunities in markets where green credentials are fast becoming non-negotiable. More than just an energy source, solar smart energy is an investment in resilience, profitability, and long-term growth.

Businesses that embrace this transition now will not only secure a financial advantage but also earn a leadership position in the global shift toward clean energy. The question is no longer if solar smart energy will define the future—it’s who will be bold enough to lead that future today.

The future of energy is already here—are you ready to lead it? At Soleos Energy, we make it simple for businesses to cut costs, boost efficiency, and shine as sustainability leaders. Let’s turn your rooftops and open spaces into profit-making powerhouses. Connect with our team today and start powering your business with the sun!

FAQs on Solar Smart Energy India

1. What is Solar Smart Energy and how does it benefit businesses?

Solar smart energy combines solar power with energy storage, digital monitoring, and smart energy management. It ensures efficient power generation, reduces costs, and provides reliable, uninterrupted electricity for industrial operations.

2. How much can businesses save by switching to solar smart energy?

Depending on energy consumption and project scale, companies can reduce electricity costs by 30–50%, with additional savings from optimized load management and storage integration over the system’s lifetime.

3. What is the typical payback period for industrial solar projects?

Most industrial installations achieve ROI in 3–5 years, after which electricity generated is almost free, delivering long-term cost savings and operational efficiency.

4. Can solar smart energy ensure uninterrupted operations for industries?

Yes. With energy storage and smart management, businesses can maintain continuous operations even during grid outages or peak demand periods, enhancing resilience and productivity.

5. Does investing in solar smart energy improve sustainability and ESG performance?

Absolutely. Solar adoption reduces carbon emissions, strengthens ESG credentials, and improves brand reputation, helping businesses meet global sustainability standards and attract conscious customers and investors.

6. How can a business get started with solar smart energy?

The first step is a site assessment and energy audit. Experienced providers like Soleos Solar Energy offer end-to-end solutions—from design and installation to monitoring and maintenance—tailored to industrial needs and energy goals.