In today’s rapidly evolving solar industry, optimizing energy generation is not just about installing panels and inverters—it’s about designing systems that deliver maximum efficiency and cost-effectiveness. One of the most critical parameters in solar engineering is the DC and AC ratio, often referred to as the Inverter Loading Ratio (ILR).

Whether you are building a utility-scale solar power plant, a commercial rooftop project, or a hybrid solar + storage system, understanding the DC and AC ratio can make the difference between an average-performing plant and a highly profitable one.

Table of Contents

This blog will provide a deep dive into the concept of DC and AC ratio, its importance, how aggressive ratios can be beneficial, the risks involved, and the future trends shaping solar plant design.

What is DC and AC Ratio?

DC (Direct Current) → is the power generated by the solar photovoltaic (PV) modules. Panels are rated in kWp (kilowatt-peak), which is their maximum capacity under standard test conditions.

AC (Alternating Current) → is the usable power output delivered by the solar inverter after converting DC into AC. Inverters are rated in kWac (kilowatts AC).

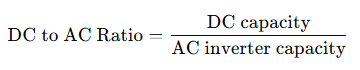

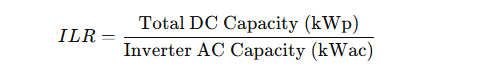

The DC to AC Ratio—also known as the Inverter Loading Ratio (ILR)—is the simple yet powerful relationship between:

- DC capacity: the total rated power of your solar modules (in Watts or kW<sub>p</sub>), and

- AC capacity: the inverter’s maximum power output (in Watts or kW<sub>ac</sub>).

Formula:

For example, a 9 kW_DC solar array connected to a 7.6 kW_AC inverter gives:

Why It Matters

1. Better Use of Inverters

Solar panels rarely produce full-rated power all day. Oversizing DC relative to AC allows the inverter to operate near peak efficiency during most hours.

2. Minimized Energy Wastage

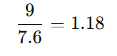

When the panel output exceeds inverter limits, clipping occurs—where excess energy is lost. For example:

- A ratio of 1.5 may result in 2–5% annual clipping loss.

- A 1.2 ratio typically keeps losses below 0.25%.

3. Improved Energy Yield

Oversizing DC can boost annual energy production significantly while keeping losses low. A real-world case: a plant with a 1.3 ratio delivered a 12% yield increase with just 2% clipping.

4. Industrial Benchmarking

In the U.S., as of 2016, typical inverter loading ratios ranged between 1.13 and 1.30, with a capacity-weighted average of 1.25.

Why DC and AC Ratio Matters in Solar Design

1. Maximizing Inverter Efficiency & Energy Harvesting

Solar panels rarely produce their nameplate capacity under real-world conditions—thanks to factors like temperature, angle, and soiling, full-rated output happens so infrequently that systems are often sized with DC capacity exceeding inverter capacity to make better use of available power. The result? Inverters operate closer to their optimal range more often, boosting energy yield.

2. Balancing Clipping Losses

Oversizing the DC side means there’s a risk of clipping—when solar array output exceeds inverter limits, and excess energy goes unused. Yet, modest clipping losses can be acceptable if they unlock significantly higher overall energy yield. For instance:

- 1.4 DC/AC ratio: ~3% clipping

- 2.0 DC/AC ratio: Clipping can soar to nearly 20%

Smart architects balance between clipping and efficiency to find the optimal ratio

3. Lower Equipment Costs

Inverters are more expensive per watt than solar modules. Oversizing DC capacity relative to inverter size reduces capital expenditure while boosting system output—especially beneficial for large-scale plants.

4. Adaptation to Geographic & Climate Conditions

- Cloudy or Low-Irradiance Regions (e.g., northern Europe): Higher DC/AC ratios (1.3–1.5) compensate for fluctuating sunlight levels.

- High-Irradiance Regions (e.g., deserts): Lower ratios (1.1–1.2) help avoid excessive clipping during intense sunlight.

5. Strategic Design – Capex, Yield & Clipping Trade-Offs

Design involves a trade-off: smaller inverter cost versus clipping loss. Models show that while clipping increases beyond a comfortable point, equipment savings diminish, making 1.2–1.3 a common optimal choice.

Understanding Inverter Loading Ratio (ILR)

The Inverter Loading Ratio (ILR) measures the relationship between the total installed solar panel capacity (DC) and the inverter’s output capacity (AC).

Formula:

- DC (Direct Current) → Power generated by PV modules, rated in kilowatt-peak (kWp).

- AC (Alternating Current) → Usable power output after the inverter converts DC into AC, rated in kilowatts AC (kWac).

- ILR < 1.2: Conservative, avoids inverter clipping but underutilizes inverter capacity.

- ILR 1.2–1.4: Balanced, widely used in utility-scale plants.

- ILR > 1.5: Aggressive, higher energy yield in low irradiance but may result in clipping losses.

Benefits of Higher DC and AC Ratio

1. Maximized Inverter Utilization

Solar panels often struggle to reach their full capacity due to factors like heat, dust, and cloudy weather. To improve energy output, solar panels can be oversized on the DC side, ensuring the inverter works closer to full capacity more frequently, thereby enhancing energy capture throughout the day.

2. Lower Cost per Unit of Energy (LCOE)

Solar panels are more affordable per watt than inverters, and adding more modules increases annual generation by 10-20% while slightly increasing project cost by 5-10%. This reduces the Levelized Cost of Electricity (LCOE) and strengthens the project financially.

3. Higher Annual Energy Yield

Transitioning from a 1.0 to 1.3 DC/AC ratio can increase annual production by 5-15% with minimal clipping losses. For instance, a 50 MW plant with a 1.3 ratio can generate 25-30 GWh annually. Oversizing can increase annual yield by over 28% with only a 10% increase in installation cost. Even modest overbuild can significantly boost returns.

4. Reduced Inverter Costs and Smarter Design

Oversizing allows for the use of lower-rated inverters, resulting in direct equipment savings, particularly in large systems where inverter costs and balance-of-system components scale with AC capacity. This is particularly beneficial for large-scale solar parks and space-constrained rooftops.

5. Better Adaptation to Climate and Location

In low-irradiance regions like Europe and the UK, higher DC/AC ratios offset weaker sunlight, while moderate ratios prevent excessive clipping and maximize returns in high-irradiance regions like UAE and India, while deserts often benefit from more conservative ratios.

6. Improved Real-World Efficiency

Higher DC/AC ratios in systems start producing earlier and maintain output longer, even in low light conditions. This ensures earlier inverter start-up and later shut-down, capturing energy during morning and evening hours, which smoothens generation curves, particularly beneficial for manufacturing units with steady daytime energy demand.

Risks of High DC and AC Ratio

1. Excessive Clipping Losses in High Irradiance Zones

India receives 1,600-2200 kWh/m² of solar radiation annually. Oversizing the DC capacity beyond 1.4 can lead to clipping losses of 3-6%, especially during peak sunshine. At a 1.2 ratio, clipping is less than 1%, but at a 1.5 ratio, losses can exceed 5%, affecting the benefits of extra panels. Oversizing the DC side can lead to increased energy clipping, potentially affecting optimized generation if not managed carefully.

2. Design Challenges in Balancing Overload & Performance

Optimizing DC overloading requires modeling trade-offs: gaining more energy during off-peak hours but experiencing clipping during peak hours. This balance is complex and further impacted over time by module degradation, which gradually reduces clipping losses but requires careful long-term planning.

3. Reduced Efficiency from High Temperature Conditions

Most Indian solar sites endure ambient temperatures above 40 °C. High temperatures can lower module DC output (thermal derating), impacting overall efficiency. In such conditions, overloading the DC side might seem beneficial due to reduced peak performance, but it can also strain inverters and reduce their operational lifespan.

4. Land Constraints and Higher CapEx

Increasing DC capacity demands additional land—often a significant cost driver for utility-scale solar parks. In space-constrained regions or rooftops, high DC/AC ratios may not be practical and can jeopardize both cost efficiency and feasibility.

5. Regulatory and Grid Limitations

While newer solar tenders in India may not explicitly cap DC overloading, many state DISCOMs and CEA guidelines implicitly discourage aggressive oversizing, especially in high-irradiance zones. Exceeding acceptable DC/AC ratios might lead to delays in approvals or penalties.

6. Potential Inverter Warranty and Component Stress

Oversizing beyond manufacturer-approved DC/AC ratios may void inverter warranties. Additionally, under prolonged high-load conditions—especially in heat—key components may suffer premature wear or failure.

Regional Practices in DC and AC Ratio

The DC and AC Ratio (Inverter Loading Ratio – ILR) isn’t a “one-size-fits-all” number—it varies widely depending on climate, irradiance, energy policy, and economics. Let’s explore how regions across the world (and within India) adapt their design practices.

India: The government has allowed developers to oversize DC as long as AC export/CUF obligations are met, allowing for widespread DC overloading. This practice is widely used to boost morning/evening yield, but must be balanced against midday clipping and heat-driven inverter derating. A practical band for most utility and C&I is 1.20-13.55.

Europe: In Germany, small PV systems were once subject to the “70% rule,” meaning feed-in was capped at 70% of their DC rating. This policy effectively elevated the DC and AC Ratio, encouraging higher DC-side sizing relative to inverter capacity and accepting some clipping. For continental European sites, the optimal DC and AC Ratio typically lands around 1.15–1.20, though export caps may justify slightly higher ratios if occasional clipping remains economically acceptable.

United States: Utility-scale solar projects in the U.S. generally use a DC and AC Ratio between 1.20 and 1.35, with a capacity-weighted average of about 1.25. Evidence also shows that higher DC and AC Ratio values are linked to lower long-term performance degradation, making moderate oversizing increasingly acceptable. NREL’s techno-economic models treat the DC and AC Ratio as a key variable in optimizing capacity factor and LCOE.

Middle East & Africa: In hot desert climates like the GCC, design standards for DC and AC Ratio prioritise limiting thermal stress and dust impact. Regulatory guides—such as those from DEWA—ensure installations abide by stringent performance testing and safe limits. Although equipment is often specified to tolerate DC and AC Ratio values up to around 1.5, practical project designs in high-irradiance MEA regions typically keep the ratio between 1.10 and 1.30 after detailed climate and economic modeling.

How to Optimize DC and AC Ratio in Solar Projects

1. Understand the Fundamentals

The DC and AC Ratio is the ratio of a solar array’s DC capacity to the inverter’s AC capacity. It is typically aimed at between 1.2 and 1.5 to improve energy yield without additional inverter costs. For instance, a 100 kWp DC array with an 80 kW AC inverter would have a 1.25 ratio. Most projects aim for a ratio between 1.2 and 1.5, but the optimal value depends on site-specific conditions.

2. Compensate for Real-World Losses

Common losses in inverters include mismatch, shading, and cabling, with module degradation occurring in the first year and increasing over 30 years. Oversizing the DC side helps maintain optimal performance. Unavoidable energy losses include soiling, wiring, and mismatch, with degradation occurring in the first year and increasing annually.

3. Match Climate & Site Characteristics

To optimize solar energy capture, consider the specific climate, irradiation pattern, and temperature profile of the site. For hot, high-irradiance areas, use lower DC and AC ratios to avoid thermal stress and clipping. For cloudy or diffuse-light zones, use higher ratios to capture energy during non-peak times. Tailor the ratio to suit the specific conditions.

4. Validate with Experience

Solar pros on Reddit suggest oversizing panels by 120-140% DC to AC to start the inverter earlier and capture more power in lower light. To simulate performance with different ratios, use PVsyst, SAM, or HelioScope, run LCOE analysis, and use SCADA monitoring for real-world optimization after commissioning.

Future of DC and AC Ratio in Solar

The DC and AC Ratio (Inverter Loading Ratio, ILR) is becoming increasingly important in solar design as costs drop and technology advances. Traditionally, solar plants used ratios of 1.2–1.4, but with module prices falling by nearly 90% in the last decade, oversizing DC capacity is now more economical. This means future plants could adopt higher ratios of 1.4–1.7, especially in temperate or cloudy regions where maximizing inverter output is crucial.

Regional practices will vary: India, the Middle East, and Africa are expected to keep ratios conservative at 1.2–1.35 due to high heat and irradiance, while Europe may go as high as 1.6, and the USA will likely remain around 1.25–1.4. At the same time, modern inverters supporting 150–200% DC oversizing, along with battery storage systems, will allow plants to store excess DC instead of losing it through clipping.

Looking ahead, the future of the DC and AC Ratio will be defined by higher ratios, smarter inverters, storage integration, and smart grids. What was once a trade-off between inverter cost and energy clipping is evolving into a strategy for maximizing efficiency, lowering LCOE, and ensuring flexible power supply.

FAQs on DC and AC Ratio

Q1. What is DC and AC Ratio in solar power?

The DC and AC Ratio (also called Inverter Loading Ratio – ILR) is the ratio between the total installed DC capacity of solar panels and the AC capacity of the inverter. For example, if a solar plant has 10 MWp DC capacity and an 8 MW AC inverter, the ratio is 1.25.

Q2. Why is DC and AC Ratio important in solar projects?

It determines how efficiently the solar plant uses the inverter. A higher ratio means the inverter works closer to full capacity for longer hours, boosting energy yield and improving project economics.

Q3. What is the typical DC and AC Ratio in India?

In India, the ratio usually ranges from 1.2 to 1.35 for utility-scale and C&I projects. The limit is kept conservative due to India’s high solar irradiance and hot climate, which could otherwise cause excessive clipping and inverter derating.

Q4. Can we use a higher DC and AC Ratio in India?

Yes, but with caution. Ratios above 1.35 may lead to overheating, clipping losses, and reduced inverter life in India’s tropical conditions. Developers often run simulations to find the best balance between oversizing and performance.

Q5. How does DC and AC Ratio affect project cost?

A higher ratio means installing more solar panels, which increases initial CAPEX. However, since module prices in India have fallen sharply, oversizing is more affordable, and it can reduce LCOE (Levelized Cost of Energy) over the plant’s lifetime.

Q6. What do Indian regulations say about DC and AC Ratio?

DISCOMs and regulators in India usually cap the ratio around 1.33, though exact limits can vary depending on state policies and grid requirements. Developers must comply with the grid connection and safety codes.

Q7. What is the future of DC and AC Ratio in India?

With falling panel costs and the rise of solar + storage projects, India may gradually adopt slightly higher ratios. However, the hot climate and grid constraints mean ratios will likely stay between 1.25–1.4 for the next decade.

Conclusion

The DC and AC Ratio is one of the most critical design parameters in solar power plants, especially in India’s diverse and high-irradiance climate. Choosing the right balance directly impacts plant efficiency, inverter performance, energy yield, and project economics. While India typically operates within a safe range of 1.2 to 1.35, developers must carefully assess climate conditions, grid regulations, and financial models before deciding on the final ratio.

With falling solar panel costs and the growing role of battery energy storage systems, slightly higher DC and AC Ratios may become more common in the future. However, reliability and long-term performance should remain the guiding principles for Indian developers. Ultimately, optimizing the DC and AC Ratio is not just a technical choice—it’s a strategic decision that determines whether a solar project achieves maximum returns with minimum risks. Getting the DC and AC Ratio right can make or break your solar project. Don’t leave it to chance—Soleos Energy has helped businesses across India and beyond achieve higher efficiency and lower costs. Talk to our experts and make your solar project smarter!”