Solar Power Tracking technology is a system that orients solar panels towards the sun to capture maximum solar energy. It moves dynamically to follow the sun’s path, unlike fixed-tilt systems. This guide covers the basics of Solar Power Tracking, including its functions, types, advancements, benefits and challenges, applications, financial viability, future trends, and why it’s important for C&I solar projects. It’s a smarter way to harness sunlight’s potential.

Table of Contents

What Is Solar Power Tracking?

Solar Power Tracking is a smart solar technology that allows solar panels to follow the sun’s path, repositioning them automatically or semi-automatically to align with the sun’s rays. This dynamic movement maximizes sunlight capture and boosts energy production by repositioning photovoltaic panels at the most optimal angle, thereby maximizing energy absorption and electricity output.

Static vs. Tracking Systems

| Feature | Fixed‑Tilt (Static) | Tracking Systems |

|---|---|---|

| Energy Production | Baseline – optimized fixed tiltAnnual yield: ~1,379 kWh/kWp in Jakarta | +15–30% single‑axis, +30–45% dual‑axise.g. 1,672 kWh/kWp (≈21% gain) |

| Capital Cost (CapEx) | Lowest cost (simple structure/no moving parts) | +10–50% higher due to motors, sensors, reinforced structure |

| Maintenance (OpEx) | Minimal—just cleaning & wiring checks (~1–2% of CapEx) | Moderate to high—mechanical upkeep; modules have modular parts. Grease annually, replace motors (~10–20 min) |

| Land Use Efficiency | Dense panel placement; needs ~0.55 km² for 50 MW | Requires 15–30% more land; more spacing to avoid shading |

| System Complexity | Simple installation & design; low failure risk | More complex engineering; motors, sensors, weather protection needed |

| Weather Tolerance | Robust—can handle wind, snow, dust easily | Sensitive—may require stowing in high wind, weather‑proofing |

| ROI & LCOE | Good ROI in simple projects; low LCOE when panels are cheap | Faster ROI in high-light/price zones; lowers LCOE despite initial costs |

How Does Solar Power Tracking Work?

1. Sun Position Detection

- Light sensors detect the sun’s position using light intensity or GPS coordinates. LDRs, photodiodes, and sun sensors detect light intensity around panel edges or via masked chambers. Automated trackers use astronomical algorithms, GPS, or light sensors.

2. Controller & Algorithms

- A microcontroller calculates the sun’s position using algorithms or GPS data, determining panel positioning for optimal use. Real-time sensing and algorithm-based calculations ensure balanced sensors and optimal angles.

3. Tracking Mechanism

- Single-axis systems rotate east-west using one actuator, while dual-axis systems use a second vertical actuator for elevation tilt control. Microprocessor-controlled motors dictate movement along single-axis (East-West) or dual-axis (East-West + North-South). Single-axis trackers rotate east-west, dual-axis track both east-west and north-south.

4. Movement & Realignment

- The controller manages motor movements based on data, ensuring the panel is positioned at the brightest light source or computed sun position, and many trackers stow flat during high-wind events.

Components of a Solar Tracker:

- Solar array or PV modules

- Tracking motor or actuator

- Controller or microprocessor

- Sensors (light, weather, GPS)

- Structural frame

- Communication unit (for smart systems)

These components work in unison to ensure the solar panel remains perpendicular to the sun’s rays, thereby maximizing direct irradiance.

Types of Solar Power Tracking Systems

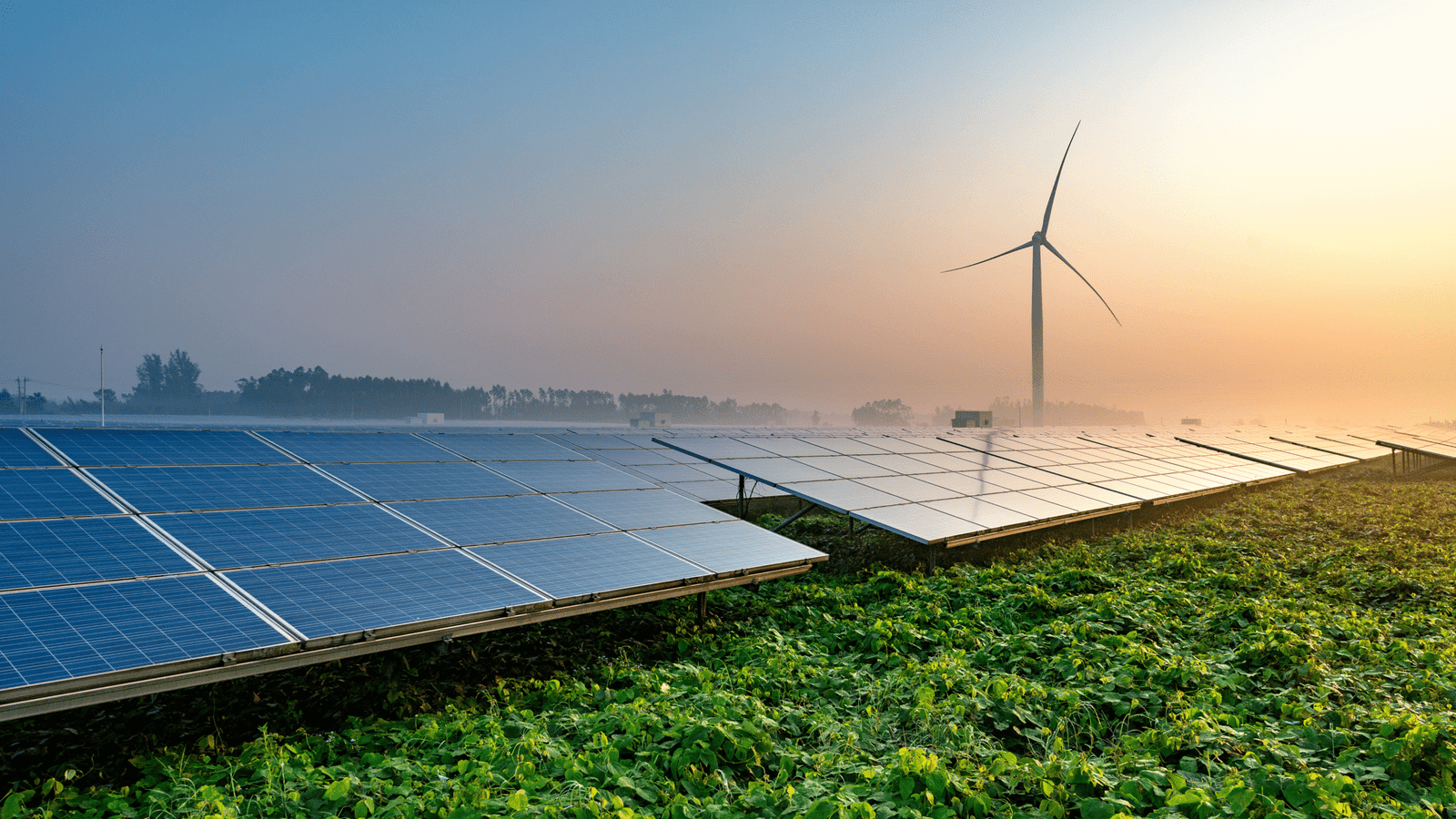

There are two main types of Solar Power Tracking systems:

1. Single-Axis Solar Trackers

- Solar trackers are devices that rotate around one axis to follow the sun’s east-west movement. These trackers are suitable for low-latitude flat sites and large installations. Horizontal Single-Axis Trackers (HSAT) rotate panels vertically, ideal for low-latitude flat sites. Horizontal Tilted Single-Axis Trackers (HTSAT) tilt the axis to match site latitude, supporting better seasonal adaptation. Vertical Single-Axis Trackers (VSAT) sweep panels east-west around a vertical pivot, better suited for high-latitude locations. Vertical-Tilted Single-Axis Trackers (VTSAT) combine vertical axis with tilting for improved sun exposure. Polar-Aligned Single-Axis Trackers (PSAT) align the axis with Earth’s pole for precise systems. These trackers can increase energy output by 20-30% and are cost-effective and mechanically simple.

2. Dual-Axis Solar Trackers

- The Alt-Azimuth Dual-Axis Tracker uses azimuth and elevation rotation for optimal positioning, while the Tip-Tilt Dual-Axis Tracker controls tilting and rotates to maintain sun-facing orientation. These trackers are mounted on poles with two-axis gimbals for flexible motion and ground-based ring mechanisms for larger arrays. They offer up to 35-45% more energy gain than fixed systems and are best suited for premium applications, high-efficiency projects, and agrivoltaic farms.

3. Comparison Table

| Feature | Single‑Axis Tracker | Dual‑Axis Tracker |

|---|---|---|

| Axes of Motion | One axis (usually East–West) | Two axes (East–West and North–South) |

| Energy Gain vs Fixed | ~20–35% boost | ~30–45% boost (+5–10% over single-axis) |

| Complexity & Mechanics | Simpler design; fewer moving parts | More complex; dual motors and gearing |

| Initial Investment | Lower CapEx (e.g. ~$0.50–1.00 /W) | Higher CapEx (~20–50% more) |

| Maintenance Requirements | Lower—a few moving parts | Higher—more parts, higher upkeep |

| Reliability & Downtime | High reliability, fewer failures | Prone to technical issues due to complexity |

| Best Fit | Large flat solar farms, moderate climates | High-latitude, space-limited, high-yield projects |

| Land Footprint Efficiency | Needs more spacing due to sun path; less dense layout | Denser & more energy per area |

| Smart-Grid Integration | Uniform output; easier forecasting | Variable output; more complex grid integration |

| Use Case Scenarios | Utility-scale, commercial rooftops | Premium, agrivoltaic, or research installations |

Benefits of Solar Power Tracking

1. Increased Energy Output

- Single-axis trackers increase energy production by 15-35%, while dual-axis trackers can achieve 40-50% more energy compared to fixed-tilt systems. These trackers optimize solar incidence angles, increasing overall solar harvest and delivering more value from every installed watt.

2. Extended Generation Hours

- Trackers optimize solar panels from sunrise to sunset, enhancing performance during early morning and late afternoon. This maximizes time-of-use benefits when electricity rates are higher, resulting in flatter generation curves and reduced battery storage dependence, resulting in more usable solar energy.

3. Better Return on Investment

- Despite higher upfront costs, additional energy generation leads to faster ROI, making it ideal for rooftop and utility-scale ground-mount systems. Higher yields result in shorter payback periods and stronger long-term gains, and pairing trackers with bifacial modules reduces LCOE by 16%.

4. Optimized Land Use

- Trackers generate more energy per square meter, reducing land needed for the same output, making them ideal for areas with high land costs or limited space, such as urban solar farms and solar carports, and ideal for industrial applications.

5. Adaptability to Site & Climate

- Customized solar power tracking systems can be tailored to various climates and geographies, with dual-axis trackers being particularly effective in high-latitude or seasonal regions, ensuring optimal tilt year-round and accommodating seasonal variations and unpredictable weather patterns.

6. Enhanced Technical Capabilities

- Solar power tracking systems use real-time algorithms, automatic backtracking, and weather stow features for optimal panel operation. They can be customized for different climates and geographies, with dual-axis trackers being beneficial in high-latitude or seasonal regions.

Challenges and Considerations

1. Higher Capital Cost

- Tracking systems typically cost 25-50% more than fixed-tilt setups, with dual-axis trackers potentially double the initial cost. This requires a thorough cost-benefit analysis, especially in regions with lower solar irradiance. However, increased generation can offset this cost over 5-10 years, especially in high solar irradiance zones. ROI must be calculated carefully.

2. Maintenance Requirements

- Tracking systems, which involve motors, sensors, and actuators, require regular inspection, lubrication, and occasional replacement. Mechanical failures can cause downtime and reduce energy yield. To minimize maintenance headaches, opt for modular designs with remote monitoring features.

3. Grid Integration Challenges

- Dynamic tracking behavior in power output may necessitate grid-side infrastructure adjustments, impacting energy forecasting and battery sizing. Coordinating with utility companies for smooth grid integration is crucial. Dynamic power output profiles may require grid flexibility and forecasting adjustments. Tracker stow operations can temporarily reduce output.

4. Land & Layout Requirements

- Trackers require wider spacing between rows to prevent panel shading during tilt or rotation, increasing the total land footprint by 15-30% compared to fixed systems. This is particularly important in land-scarce zones like urban fringes or industrial clusters, necessitating careful design and advanced backtracking algorithms.

Applications of Solar Power Tracking

Solar Power Tracking is especially valuable in the following applications:

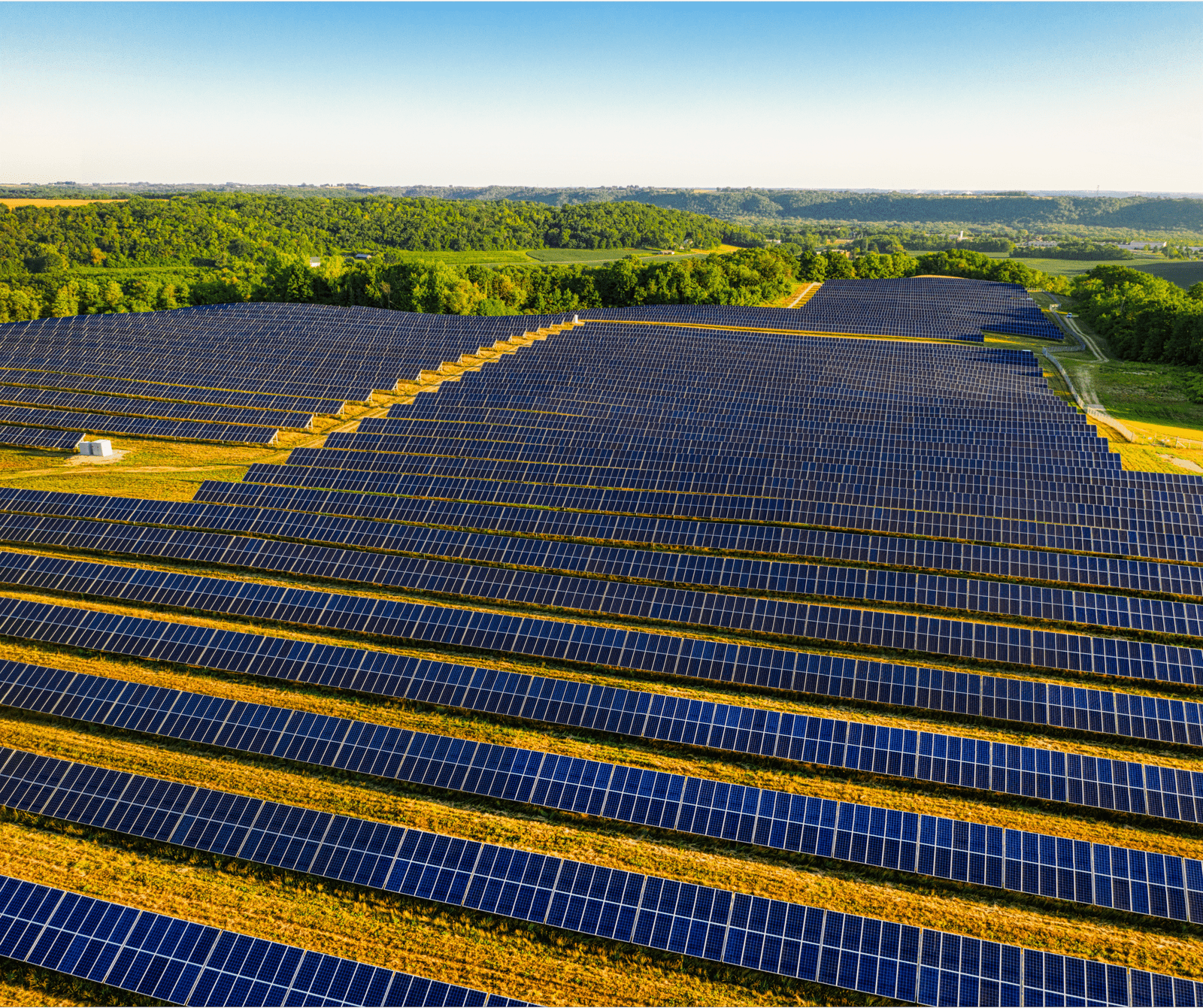

1. Utility-Scale Solar Parks

- Trackers require wider spacing between rows to prevent panel shading during tilt or rotation, increasing the total land footprint by 15-30% compared to fixed systems. This is particularly important in land-scarce zones like urban fringes or industrial clusters, necessitating careful design and advanced backtracking algorithms.

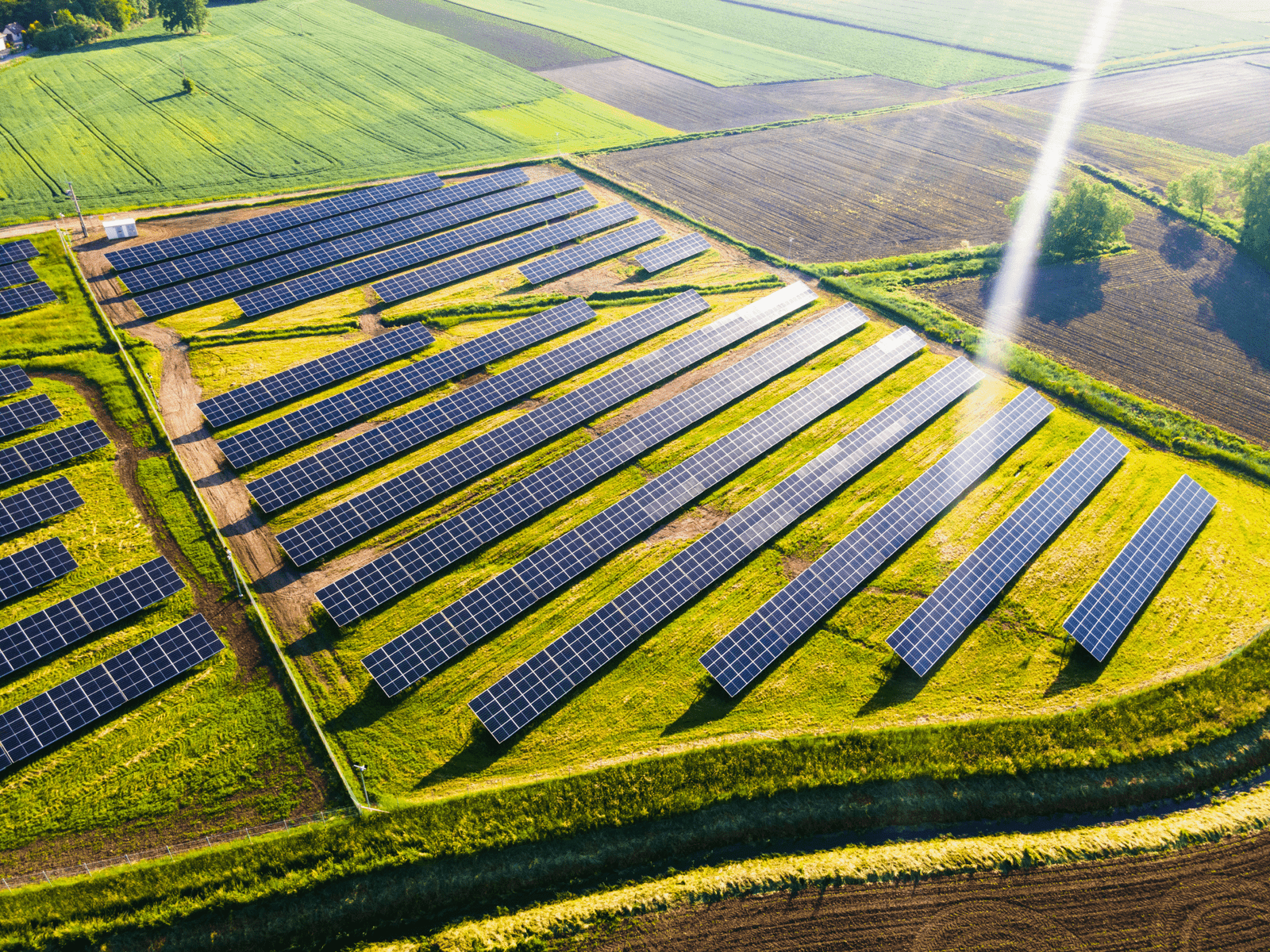

2. Agrivoltaic & Dual-Use Farmland

- Trackers combine solar energy generation with agriculture, improving land efficiency and farm income. Case studies in New Zealand show sheep grazing under HSAT panels reduces water loss, while Chile’s Ayla Solar uses twin rows of single-axis trackers to shade cherry crops. In Europe, partial shading under PV arrays increases crop resilience and reduces water use. Agrivoltaic systems with tracking can increase crop yield by up to 30% in hot climates.

3. Off-Grid & Remote Installations

- Agrivoltaic trackers provide stable power for agriculture in off-grid settings like Chile and Malaysia, effectively serving remote communities through irrigation, cold storage, and farm equipment.

Economic Analysis: Is Solar Power Tracking Worth It?

1. Upfront Cost vs. Energy Gain

- Fixed-Tilt systems have a base installation cost and standard energy performance. Single-Axis Trackers increase capital expenditure by 25-40%, improve energy output by 20-35%, and enhance generation by 30-45%. However, tracking increases upfront investment but yields significantly higher energy generation, boosting revenues and CUF in the long run.

2. Return on Investment (ROI) & Payback Period

- Commercial and utility-scale projects can achieve a 5-10 year ROI due to improved energy yield and lower LCOE. Residential installations typically have a longer ROI, typically 13-19 years. An example of a 1 MW solar plant in India shows a strong ROI for large-scale projects, especially in high solar potential states like Gujarat.

3. Lower LCOE = Better Long-Term Value

- Trackers enhance generation efficiency per kW, lowering the Levelized Cost of Energy (LCOE). When combined with bifacial solar panels, they can reduce LCOE by 15-20%. Over 94% of new U.S. utility-scale solar plants use tracking. LCOE savings justify tracker investments.

4. Operational & Maintenance Considerations

| Aspect | Fixed-Tilt | Tracking Systems |

| Maintenance Cost | 0.5–1% of CapEx/year | 1–2% of CapEx/year |

| System Complexity | Simple | Complex (motors, actuators) |

| Parasitic Energy Use | None | 0.5–1.5% of generated energy |

5. Land Use & Scale Efficiency

- Trackers require 15-20% more land for shading control but generate more energy per hectare, making them ideal for land-rich utility-scale projects. They perform best in high-DNI areas like Gujarat, Rajasthan, and Telangana, excelling when land availability and solar intensity are high.

Technological Innovations in Solar Power Tracking

1. AI & Machine Learning

- Artificial Intelligence (AI) is revolutionizing solar power tracking by introducing dynamic sun-path prediction, smart backtracking algorithms to prevent panel shading, and real-time performance optimization based on weather, load, and irradiance data. AI algorithms in single-axis trackers can adjust tilt angles every few minutes, increasing efficiency by up to 5%. Advanced trackers now self-adjust in real-time, optimizing energy capture through historical sunrise/sunset patterns and live sun position data.

2. IoT Integration

- The Internet of Things (IoT) allows real-time telemetry, remote diagnostics, and early failure detection of tracker systems. It reduces unplanned maintenance by up to 70% and O&M costs by around 25%. This technology also enables predictive maintenance through vibration and temperature sensors, allowing for centralized control of large-scale tracker arrays and automated alerts.

3. Hybrid Trackers

- Manufacturers are introducing hybrid innovations like East-West + Seasonal tilt models and semi-active systems, which combine fixed and tracking benefits and use gravity and solar heat for tilting without motors.

4. Bifacial & All-Terrain Optimization

- Trackers now feature bifacial compatibility, optimized rails for albedo light, and adapt to rolling topography, boosting LCOE by approximately 16% and enabling deployment on uneven ground.

Solar Power Tracking Around the World

1. India

- India’s solar boom is driving increased adoption of solar power tracking, particularly in Gujarat, Rajasthan, Telangana, and Madhya Pradesh. Companies like Soleos Solar, Tata Power Solar, and Adani Solar are integrating trackers to improve CUF and meet yield targets. The India solar tracker market is forecasted to grow over 20% CAGR by 2030, driven by increasing energy efficiency and tariff competitiveness. The market is projected to witness a CAGR of 12.71% between FY2025-FY2032F, growing from USD 358.68 million in FY2024 to USD 934.13 million in FY2032. Solar trackers are essential for improving the cost and performance of solar power plants and are becoming increasingly popular in utility-scale solar farms.

2. United States

- The US utility-scale solar industry is dominating, with 94% of new installations using single-axis trackers in 2022. The market value of the tracker industry has grown from $1.45B in 2023 to $3.3B by 2030, driven by leading OEMs like Nextracker, Array Technologies, and GameChange Solar. These trackers significantly reduce Land Cost of Ownership (LCOE) and maximize land efficiency, making them a standard in US utility-scale solar farms.

3. Europe

- Europe’s adoption of solar trackers is selective, influenced by land availability and solar resources. Countries like Spain, Italy, and Greece favor fixed-tilt systems due to clear skies and ample land, while Germany, Netherlands, and UK prefer fixed-tilt systems. EU-backed projects prioritize dual-axis systems in research facilities and floating tracker pilots in water-scarce areas.

4. Middle East & Africa

- Saudi Arabia, UAE, and Egypt are implementing solar mega-projects with single-axis and dual-axis tracking to optimize output in extreme heat. The Benban Solar Park in Egypt incorporates tracking across multiple developers. Kenya, South Africa, and Morocco are also integrating trackers in donor-backed utility projects. The Middle East and Africa are ideal for tracker use due to high DNI and flat, arid land.

5. Latin America

- Over 70% of large-scale solar installations in Brazil, Chile, and Argentina use tracking technology. Chile’s streamlined permitting policy has boosted adoption to 55% by 2023. Latin America is emerging as a tracker growth hotspot, particularly in high-irradiance zones like the Atacama Desert. Local players like Soltec LATAM and Ecoppia are innovating with terrain-adaptive and robotic tracker systems.

Environmental Impact of Solar Power Tracking

1. Lifecycle Carbon & Resource Efficiency

- Single-axis trackers can reduce CO₂ emissions by up to 24% compared to fixed-tilt systems due to increased energy yield per watt installed. They also reduce land use by 20% and water use by 7% per kWh generated, despite occupying more space.

2. Land Use & Biodiversity Considerations

- Solar trackers can increase land footprint by 15-20% due to row spacing and tilt clearance. They can be installed on brownfields, degraded lands, or semi-arid zones, allowing sunlight penetration for vegetation growth, pollinator habitats, and agrivoltaic farming. Proper planning can enhance biodiversity. However, poor site design can cause habitat fragmentation and water runoff.

3. Water Use & Soil Health

- Trackers can significantly reduce water consumption by 7-10% per kWh for cleaning and cooling in arid regions due to self-cleaning angles and optimized panel orientation, while mitigating issues like erosion or compaction with engineered drainage systems.

4. Wildlife & Habitat Interaction

- Large-scale solar farms can disrupt animal migration and natural behaviors, but solar power tracking systems can reduce shading density and support ground-level ecosystems. Mitigation strategies include hedgerows, pollinator cover crops, wildlife pathways, anti-glare coatings, and floating solar with tracking for low-impact solutions in ecologically sensitive areas.

5. Sustainable Materials & Circular Design

- Nextracker uses recycled steel and aluminum in construction, reducing carbon emissions by up to 35%. Modular trailers facilitate easy disassembly, recycling, and repowering. Smart tracking systems minimize panel movement, ensuring long-term sustainability.

Soleos Solar’s Expertise in Solar Power Tracking

At Soleos Solar Energy Private Limited, we don’t just follow the sun — we lead with precision, innovation, and expertise. With over 12 years in the solar industry, 160+ completed projects, and a portfolio exceeding 450MW+, Soleos has positioned itself as a pioneer in solar power tracking systems for commercial, industrial, and utility-scale applications.

- Advanced Solar Power Tracking Technologies: The company offers solar power tracking solutions, including Horizontal Single-Axis Trackers (HSAT) for flat terrains and large solar parks, Tilted Single-Axis Trackers (TSAT) for optimizing seasonal solar angles, and Dual-Axis Trackers for precision and output in high-DNI zones.

- Proprietary Engineering & Custom Design: Our engineering team creates wind-load and terrain-optimized tracker-mounted structures using recyclable materials, rigorous structural analysis, and QA/QC processes. Smart sensors and automation systems enable real-time sun tracking and remote O&M monitoring.

- Seamless EPC + Tracker Integration: Soleos Solar is a comprehensive EPC provider that manages the entire project lifecycle, including feasibility, design, engineering, procurement, construction, commissioning, and O&M with tracker-specific maintenance support, ensuring system efficiency and faster ROI.

- Global Deployment Experience: With successful tracker-based solar installations in Spain, Germany, the UK, UAE, Kenya, and across India (Gujarat, Rajasthan, Telangana) — we bring deep regional insight and localized performance optimization for every geography.

- Value Delivered Through Innovation: Single-axis systems generate 35-40% more energy, reduce LCOE by 18-20%, support bifacial panels, and offer 24×7 SCADA-based monitoring for predictive O&M.

Future of Solar Power Tracking

- Aims to achieve 500 GW renewable energy target by 2030.

- Solar power tracking systems crucial for clean energy future.

- Market projected to reach $469 million by 2033 (5.2% CAGR).

- Market expected to reach $1.6 billion by 2030.

- Regional hotspots leading due to optimal solar irradiance, expansive land banks, and strong policy push.

- Single-axis trackers preferred for utility and commercial projects.

- High Direct Normal Irradiance states capitalizing on trackers for enhanced energy harvest and land utilization.

- Policy landscape favors high-performance solar tech.

- Domestic tracker manufacturing and supply chain evolution driving innovation.

- Future innovations include floating trackers, IoT-powered systems, AI & Machine Learning platforms, and strategic value for utility and commercial projects.

Conclusion: Tracking Toward a Brighter Future

India is embracing a solar revolution, with solar power tracking systems playing a crucial role in maximizing sunlight. These systems, whether single-axis or bifacial, offer higher energy output, lower levelized cost of electricity, and faster ROI. As government support, domestic manufacturing, and smart technologies align, solar power tracking is becoming the standard, not the exception.

Soleos Solar offers intelligent, future-proof energy systems tailored to your goals, with over 450+ MW delivered across 160+ projects in 7+ countries. With world-class experience, they are ready to take your solar project to the next level.