At Soleos Solar, we believe in empowering businesses with clean, cost-effective, and scalable solar energy solutions. One of the most promising models revolutionizing commercial and industrial power consumption is the Group Captive Solar Power model. In this guide, we explore everything you need to know about this game-changing concept.

Table of Contents

What is Group Captive Solar Power?

Group Captive Solar Power is a collaborative renewable energy model where a group of commercial or industrial consumers jointly develop and procure solar power—typically through a Special Purpose Vehicle (SPV)—to meet their energy needs under India’s Electricity Act framework. Key features include:

Definition & Regulatory Framework

- A Group Captive Power Plant is defined by two mandatory conditions:

- At least 26% equity ownership by captive consumers (combined).

- Minimum 51% annual consumption of generated power by those same captive consumers collectively.

- These projects operate under the Open Access mechanism, allowing power wheeling from the solar plant to the consumers’ premises via the grid

Why Group Captive is a Game-Changer for Indian Industry

1. Significant Cost Savings

- Group Captive Solar offers 30-50% lower tariffs than conventional grid electricity, avoiding cross-subsidy surcharges and additional surcharges, resulting in 30-50% savings on energy costs compared to traditional grids.

- The levelized cost of solar power typically undercuts traditional grids, delivering long-term value.

2. Enhanced Energy Security & Reliability

- Captive solar reduces dependency on unreliable grid supply by generating load near point-of-use. This allows industries to gain autonomy over power, mitigating disruptions and avoiding costly downtime. Captive power enhances operational efficiency and is available on your terms.

3. Environmental & ESG Advantages

- Transitioning to clean solar power reduces carbon emissions, aligns with sustainability goals, and boosts corporate reputation. Group Captive Solar reduces carbon footprint, boosts green brand reputation, and helps meet net-zero and CSR goals.

4. Regulatory & Financial Incentives

- Group captive solar investments are financially competitive due to exemptions on cross-subsidy and additional surcharges. Government policies, including Electricity Rules (2022), tax benefits, and net metering and banking benefits, support this legally sound, financially viable, and future-ready model.

5. Shared Investment, Shared Risk

- Pooled equity allows industries to invest without individual capital, allowing mid-sized manufacturers and industrial clusters to share benefits without full risk. This reduces per-company burden and distributes long-term operational risk, making it affordable for SMEs.

6. Scalability & Flexibility

- The plant is easily expandable, allowing participants to focus on core business operations. Developers manage the plant, while participants lock in energy prices for 15-25 years, ensuring stability and scalability. Tax benefits and accelerated depreciation on solar assets are also included.

7. Strategic Business Edge

- Industries are gaining energy independence, saving money, and enhancing their ESG positioning, gaining a competitive advantage due to regulatory momentum like Electricity Rules 2022.

How Does the Group Captive Model Work?

The Group Captive Solar Power Model is a powerful mechanism that allows multiple commercial or industrial entities to collectively own and use solar power without having to individually invest in a full solar plant. Instead of generating solar energy on their rooftops, they pool resources to invest in an off-site solar plant, gaining access to clean energy at a significantly reduced cost. Let’s break down the entire process step by step:

Step-by-Step Flow:

1. Formation of SPV (Special Purpose Vehicle)

- A Special Purpose Vehicle (SPV) is a legally registered entity owned and operated by a group of consumers, either by a developer or jointly by participating companies. The SPV’s equity is held by consumers, who own at least 26% of its paid-up capital, meeting the captive-status requirement mandated by Indian law.

2. Equity Contribution

- Each participant’s equity share corresponds to its right to receive power, ensuring transparent and proportional benefit. The combined captive partners must consume at least 51% of the annual solar energy output. Each business purchases equity, signs agreements, and gains a proportionate share of the generated power.

3. Power Purchase Agreement (PPA)

- A Power Purchase Agreement (PPA) is a contract between a supplier (SPV) and industrial consumers, outlining tariff rates, tenures, delivery terms, and exit clauses, with each captive consumer specifying their tariff rate, tenure, and equity-to-power allocation terms.

4. Open Access Approvals

- The SPV obtains Open Access approvals from electricity regulators, enabling solar power to be transported to consumers’ facilities through the grid.

5. Billing

- Consumer partners pay for energy based on their allocation, typically 30-50% cheaper than grid tariffs. They save by exempting from Cross-Subsidy Surcharge and Additional Surcharge under regulated open access.

Group Captive vs Captive vs Open Access Solar

| Feature | Captive | Group Captive | Third-Party Open Access |

|---|---|---|---|

| Ownership | 100% by a single consumer | ≥26% combined by multiple consumers | 100% by the developer |

| Minimum Equity Requirement | ≥26% (by single user) | ≥26% (combined by all users) | None |

| Minimum Power Consumption | ≥51% of generated power | ≥51% of generated power (by all users) | All power consumed as per PPA |

| Upfront Investment | High (full plant cost) | Shared (lower per user) | None |

| Tariff Control | Full control over tariff | High control (shared decisions) | Limited — as per developer’s PPA |

| Cross-Subsidy & Addl. Surcharge | Exempted | Exempted | Not exempted |

| CAPEX Requirement | High | Medium (shared investment) | Zero |

| O&M Responsibility | User or O&M partner | Developer or SPV manages | Developer manages |

| Complexity | Moderate (single ownership) | High (multi-party SPV & compliance) | Low |

| Project Setup Time | Moderate | Moderate to high | Quick |

| Scalability | High (depends on consumer) | High (shared consumption) | High |

| Ideal For | Large energy-intensive industries | SME clusters, multi-factory owners | Companies seeking quick, no-capex solutions |

Key Legal and Regulatory Requirements

1. Ownership Requirement – Minimum 26% Equity: To qualify as a group captive consumer under the Electricity Rules, 2005, consumers must collectively own at least 26% of the equity in the Special Purpose Vehicle (SPV) that owns the solar power plant. This ownership must be direct and consistent throughout the Power Purchase Agreement (PPA). For example, five companies investing in a 10 MW plant must collectively hold 26% or more equity shares.

2. Minimum Energy Consumption – At Least 51%: The CEA and MoP guidelines mandate that participating consumers must consume at least 51% of the total electricity generated by the plant annually, which must be direct and not resold or diverted. Failure to meet this benchmark may result in loss of surcharge exemptions and withdrawal of group captive status.

3. Annual Compliance & Certification: To maintain captive status, annual CA-certified compliance is necessary for captive consumers to have at least 26% equity and 51% power consumption. Group captive projects must apply for Open Access with the State Transmission Utility or SLDC, submit project details, and receive approval from the state nodal agency.

4. Power Purchase Agreement (PPA): A legally binding PPA must be signed between the solar plant owner (SPV) and each consumer, covering tariff structure, term (15-25 years), equity-to-power entitlement, exit clauses, governance, and dispute resolution. This contract ensures clarity in rights and obligations, is essential for grid connection, open access approval, and financial closure of the project.

5. Energy Accounting, Metering & Scheduling: Real-time energy metering is mandatory at generation and drawal points, and SPV must schedule generation with SLDC according to the Indian Electricity Grid Code (IEGC). Deviations may result in penalties under the DSM mechanism. Net generation is calculated after deducting auxiliary consumption.

Group Captive Solar Power in Different Indian States

The Group Captive Solar Power model is gaining traction across India, driven by rising commercial & industrial (C&I) electricity tariffs, supportive regulations, and the need for sustainability. However, the implementation, incentives, and regulatory frameworks vary significantly from state to state. Understanding these differences is essential for businesses planning long-term solar investments.

1. Karnataka

- India’s mature state offers Open Access and Group Captive models with attractive waivers, monthly banking, and competitive charges for transmission and wiring. It’s ideal for medium to large C&I units with consistent daytime load. A pioneer in open-access solar, it has strong incentives through 2018 and high viability of group captive due to surcharge exemptions and streamlined open access.

2. Tamil Nadu

- The state, one of the first to adopt solar OA aggressively, offers 100% CSS and AS waivers for group captives, monthly energy banking, and a transparent application process. It benefits large industrial bases, favoring both brownfield and greenfield manufacturing units. However, limited O&M infrastructure may delay project rollout.

3. Maharashtra

- The solar energy industry has significant potential due to industrial consumption, offering exemptions for CSS and AS for group captive projects. Monthly banking is available, but wheeling charges are slightly higher. Approvals may take longer due to state bureaucracy. Strong solar irradiance makes investment worthwhile.

4. Gujarat

- The policy supports wind-solar hybrids and group captive solar, offering a 50% reduction in wheeling charges and CSS exemptions. It also provides daily or monthly banking with applicable charges. The policy is top 5 for OA growth and is beneficial for developers expanding hybrid or park-based group captive models.

5. Rajasthan

- The solar sector in India has significant potential and is experiencing growth in OA installations. It offers exemptions for CSS and transmission charges for plants up to 25 MW, and allows monthly banking with carry-forward limits. This business offers competitive land and EPC costs and high ROI for manufacturing clusters.

6. Uttar Pradesh

- The Open Access solar state is experiencing rapid growth, with a 400% YoY increase. It offers a 10-year wheeling and transmission waiver for captive users and bi-directional banking at a 6-10% charge. This policy offers a business advantage for emerging industrial clusters, making it ideal for early entrants.

Who Should Choose Group Captive Solar Power?

Group Captive Solar Power is one of the most strategic and cost-effective energy models available for commercial and industrial (C&I) consumers in India. Unlike traditional energy sourcing methods, this model empowers businesses to own a share in a solar power plant and enjoy long-term savings, energy security, and sustainability benefits — without bearing the full capital cost alone.

- Large Industrial Consumers with High Power Bills: Group Captive is a cost-effective solution for manufacturing units, factories, or processing plants that consistently consume 1 MW or more of power and pay high per-unit rates. It reduces energy costs by 30%-50%, exempts from Cross Subsidy Surcharge (CSS) and Additional Surcharge (AS), and ensures energy cost predictability for 15-25 years.

- Multi-Location Businesses Wanting Centralized Power Strategy: The Group Captive model is a centralized power procurement strategy that allows for flexible power allocation across units, uniform energy policy, and simplified financial planning. It is best suited for large corporations, FMCG manufacturers, logistics parks, and multi-site industrial clusters, and businesses with moderate energy needs. It requires only 26% combined investment and can scale as needs grow.

- Businesses Wanting to Avoid Full Capital Expenditure: Group Captive Solar is a solution for Capex-sensitive businesses seeking ownership benefits like tariff savings, environmental credits, and policy incentives. It requires only 26% equity investment and typically returns within 3-5 years. Ideal for SMEs, corporates with green goals, and PE-backed ventures, it allows centralized solar power procurement.

- Environmentally-Conscious Companies with ESG Goals: Group Captive offers real renewable energy credits (RECs) and significantly reduces Scope 2 emissions for businesses aiming for sustainability, Net Zero targets, or ESG compliance. It provides 100% green power, strong sustainability reporting value, and enhances brand and investor credibility, making it ideal for export-oriented units, listed companies, ESG-driven brands, and global MNCs.

ROI in Group Captive Projects

- Capital Cost: ₹4–5 crore per MW, including land, solar plant, and grid interconnection.

- Equity Requirement: Consumers only invest 26% equity to participate in the project.

- Energy Savings: ₹1.5–₹3.9 per kWh depending on the state and applicable grid tariffs.

- Payback Period: 1 to 3 years for equity recovery; even quicker in states like Tamil Nadu or Uttar Pradesh.

- Example Case:

- Investment: ₹3.31 crore for a 1 MW solar plant.

- Revenue: ₹3.81 lakh/month or ₹45.7 lakh/year.

- ROI: ~14% annually for the first five years.

- Accelerated Depreciation:

- 40% in Year 1 + 20% in Year 2 under Section 32 of the Income Tax Act.

- Significantly reduces taxable income.

- Annual Output: ~1.5 million kWh (1.5 million units) per 1 MW plant.

- Annual Cash Savings: ₹30–₹58 lakh, based on per-unit savings.

- Annual ROI on Equity: 23%–45%, depending on savings and generation performance.

- Long-Term Benefits:

- Stable PPA tariffs (15–25 years).

- No cross-subsidy or additional surcharges.

- Consistent long-term cash flows.

- Minimal operational risks.

- Sample Scenario:

- Project Size: 10 MW.

- Your Share: 2 MW (20%).

- Equity Invested: ₹1.5 crore.

- Annual Savings: ₹80–90 lakh.

- ROI Timeline: Full payback in 2–3 years.

- Long-Term Gains: 12–15 years of low-cost, clean energy post breakeven.

Common Myths About Group Captive Solar

Myth 1: Only large corporations can participate.

Truth: SMEs and industrial clusters can pool resources to meet the 26% equity threshold for SPV ownership, benefiting from shared investment and cost efficiencies. Group Captive doesn’t require 100% capital investment from a single entity.

Myth 2: It’s legally complex.

Truth: Group Captive involves setting up a Special Purpose Vehicle (SPV) under the Electricity Act, 2003, with a well-defined legal framework. A reliable EPC partner like Soleos Solar simplifies tasks like equity structuring, approvals, compliance, and annual CA certification, providing a seamless experience.

Myth 3: Savings are not worth the effort.

Truth: Upfront investment in a 26% equity stake is limited to under ₹1.5 crore for 1 MW, often shared across group companies. Tariffs are 30-50% lower than DISCOM grid rates, resulting in a 1-3% year payback and strong ROI. Participants only invest in the 26% equity portion.

Role of EPC Partner in Group Captive Projects

Group Captive Solar Power Project Success

- EPC (Engineering, Procurement, and Construction) partner is crucial for successful project execution.

- They conduct site assessments, technical feasibility studies, and design optimized system layouts.

- Procurement involves sourcing high-quality solar components at competitive prices.

- Construction phase involves overseeing civil work, module installation, cabling, and grid integration.

- EPC partner manages timelines, budgets, and delivers within a fixed-price, turnkey framework.

- Regulatory compliance is handled, including preparation and submission of documentation for Open Access, Power Purchase Agreements, and environmental clearances.

- Post-commissioning, EPC partner handles ongoing operations and maintenance, including remote monitoring, performance analysis, and preventive maintenance.

- Performance guarantees and technical warranties offer peace of mind to investors.

- A strong EPC partner simplifies project execution, mitigates risks, and enhances ROI.

Why Choose Soleos Solar for Group Captive?

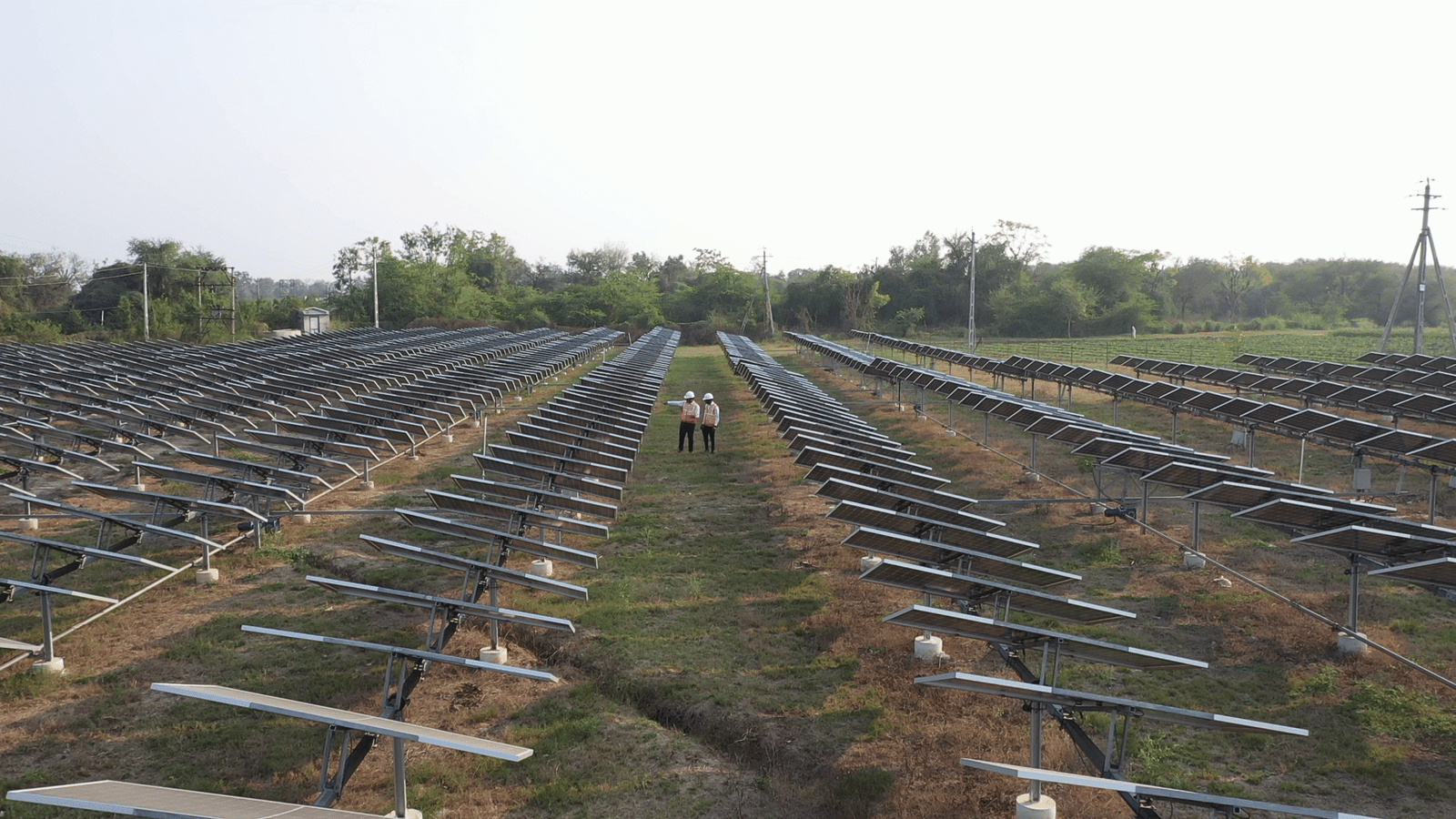

- Proven Track Record: With over 160 projects executed, Soleos Solar has a growing portfolio of 450+ MW+ solar capacity.

- Complete End-to-End EPC Expertise: Soleos Solar offers turnkey EPC services, ensuring technical optimization, financial viability, and legal compliance.

- Strong Financial Backing: Soleos Solar raised INR 48.5 Cr in Series A funding in 2024, providing capital and credibility to de-risk your solar investment.

- Advanced Technology: Soleos Solar’s proprietary solar products like Antares BI 144 modules and TPSAT solar tracker systems deliver up to 35% more generation than standard fixed-tilt systems.

- Presence Across India and Global Markets: With operations across India, Spain, Portugal, the UK, UAE, Germany, and Kenya, Soleos Solar offers international best practices and reliable execution.

- Custom PPA and Legal Structuring Support: Soleos Solar handles all complexities of Group Captive, from drafting PPAs to coordinating DISCOM approvals and OA compliance.

- Long-Term O&M and Asset Management: Real-time monitoring, predictive maintenance, and on-site O&M services ensure peak plant performance.

The Future of Group Captive Solar in India

Group Captive Solar Power in India is gaining momentum due to market growth, policy reforms, and rising demand for sustainable industrial energy. The captive power generation market is expected to reach ₹1.74 trillion by 2029, fueled by renewable sources. The Green Energy Open Access Rules (2022) simplify project approvals and enable faster access to clean energy.

Solar is now the preferred choice for captive setups, often combined with wind or battery storage. States like Gujarat, Rajasthan, Tamil Nadu, and Karnataka are leading the charge with hybrid policies and banking benefits. The integration of AI-powered monitoring systems, IoT-based analytics, and smart energy management tools is making solar systems more efficient and easier to maintain. Government initiatives like solar parks and localized energy storage systems are making it easier for industries to tap into this revolution.

FAQs on Group Captive Solar Power

1. What is the Group Captive Solar Power model?

A Group Captive Solar Power project is one where multiple businesses collectively own at least 26% equity in a solar plant and together consume at least 51% of its power output. This qualifies them for captive power benefits under Indian regulations.

2. How can a company benefit from Open Access without full ownership?

Each business needs to hold at least 26% equity in the SPV, while the developer or other investors can hold the remaining 74%. The consumer then enters into a long-term PPA with the SPV, allowing access to solar power without fully owning the plant .

3. What are the main advantages of the Group Captive model?

Key benefits include:

- Lowest landed cost of power through surcharge exemptions,

- Shared capital burden via 26% equity investment,

- Long-term tariff stability,

- Enhanced ESG profile through clean energy use.

4. How do we ensure compliance and avoid legal risks?

Compliance involves two core criteria:

- Real paid-up equity of at least 26% by captive users with vested rights,

- Collective consumption of at least 51% of power matching their equity share.

Failing either can result in loss of group captive status and related benefits.

5. What happens if we want to terminate the PPA or exit the agreement?

Termination clauses typically include put/call options so equity shares can be transferred to another captive user or back to the SPV/developer. However, share transfers must comply with RBI guidelines if foreign ownership is involved.

6. Who handles operations and maintenance (O&M)?

Operational and maintenance responsibilities are usually taken up by the developer, ensuring hassle-free power delivery. Participants simply pay for the energy they consume.

7. Are there savings on grid charges?

Yes — participants benefit from full exemptions on Cross-Subsidy Surcharges (CSS) and Additional Surcharges, resulting in significantly reduced electricity tariffs compared to standard grid rates

Conclusion: Time to Go Group Captive with Soleos Solar

Group Captive Solar Power is a strategic investment model that offers Indian industries 30-50% savings on power costs, a full ROI within 1-3 years, and 15-25 years of stable, clean energy. With only a 26% equity investment, this model enables businesses of all sizes, from SMEs to multi-site corporations, to meet their sustainability goals while optimizing cash flow. With favorable policies, cutting-edge hybrid solutions, and smart energy management tech, Group Captive Solar is a viable option for businesses to future-proof their operations and contribute to India’s renewable energy goals.

Soleos Solar specializes in building high-performing, compliant, and cost-efficient projects tailored to industrial needs, offering free feasibility analysis, customized ROI projections, end-to-end EPC and O&M support, regulatory guidance, and SPV setup assistance.