India’s energy landscape is undergoing a revolutionary shift. With the push toward decarbonization and energy independence, solar panel manufacturing in India has emerged as a strategic pillar for the country’s renewable energy goals.

Table of Contents

At Soleos Solar Energy Private Limited, we’ve witnessed this transformation firsthand. From powering rooftops to building mega solar parks, the role of indigenous solar panel production is now more critical than ever. This blog explores everything you need to know about the solar manufacturing ecosystem in India—from growth trends and policies to market players and future outlook.

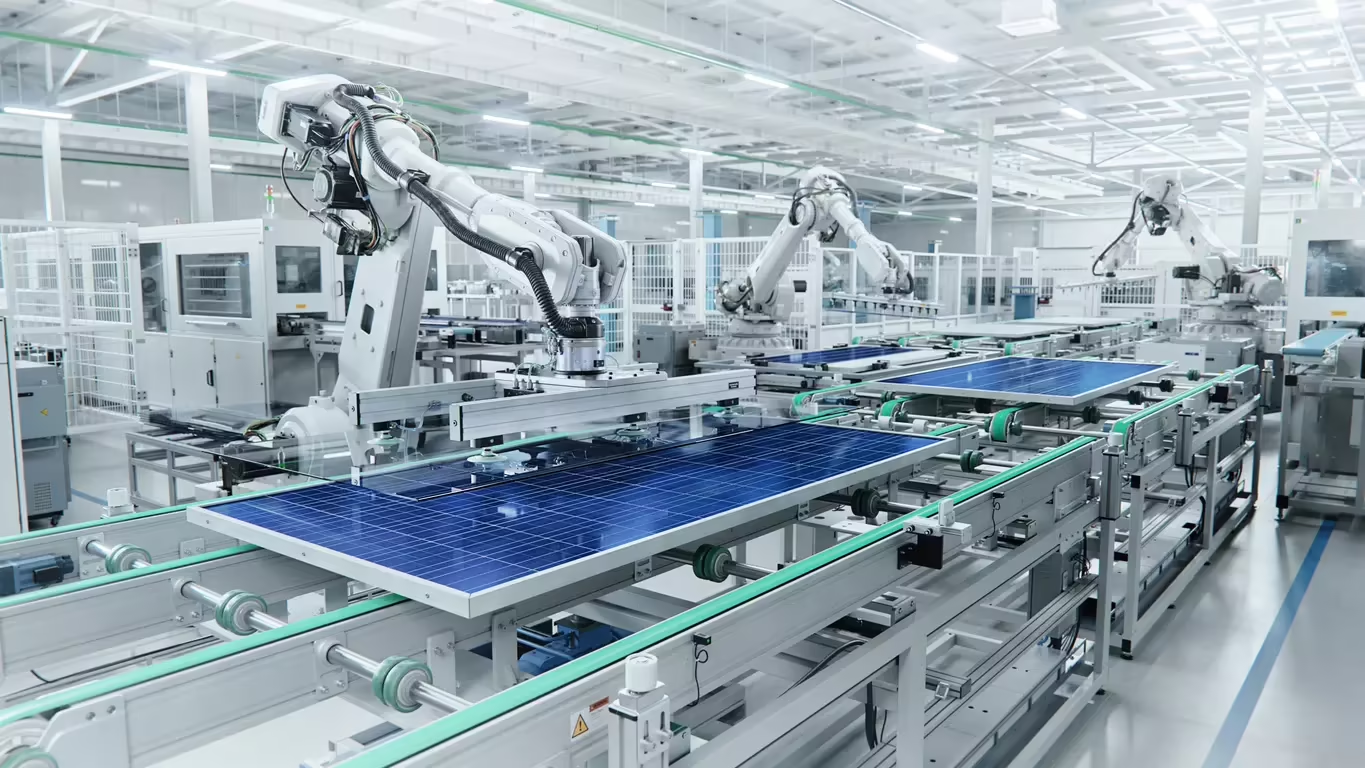

Introduction to Solar Panel Manufacturing

Solar energy is a key player in the global renewable energy movement, with solar panels being a key technology. Solar panel manufacturing involves a complex process that transforms raw materials, mainly silicon, into efficient energy-generating modules. This process involves engineering, chemistry, and innovation, from refining quartz to assembling intricate PV cells. As global demand for solar panels increases, manufacturers aim to enhance efficiency, cut costs, and ensure reliability in large-scale industrial and commercial applications.

Why Solar Panel Manufacturing in India Matters

1. Strengthening Energy Security & Supply Chain Resilience: India aims to reach 364 GW of solar PV capacity by 2032, largely reliant on imports, with 80% of polysilicon, wafers, cells, and modules coming from China, reducing global supply disruptions.

2. Advancing Self‑Reliance & Geopolitical Independence: Indian conglomerates like Adani and Reliance are investing in vertically integrated supply chains to reduce their dependency on China amid geopolitical tensions.

3. Spurring Domestic Investment & Industrial Growth: The PLI scheme, worth ₹24,000 crore, is boosting domestic capacity, with states like Gujarat, Maharashtra, and Haryana constructing new hubs and gigafactories to establish a robust ecosystem.

4. Generating Employment & Economic Value: Solar manufacturing is projected to create over 500,000 jobs by 2030, with clean-tech industries offering higher average incomes than other sectors.

5. Minimizing Carbon Footprint & Promoting Sustainability: Domestically producing panels reduces carbon emissions from imports, supporting India’s net-zero target by 2070, and promotes stronger environmental standards and greener production methods.

A Brief History of Solar Manufacturing in India

1. Early Beginnings (1990s–2009)

- India’s solar panel production began in the early 1990s with Tata BP Solar, which set up one of the country’s first solar module manufacturing units in 1991. The company’s entry into the market was driven by small pilot projects and government research initiatives. In the late 1990s, solar modules were primarily used for remote telecommunications and rural electrification, with limited market traction due to high costs and low awareness. Emvee Group entered the PV module space in 2006-07.

2. National Mission & Capacity Surge (2010–2014)

- The Jawaharlal Nehru National Solar Mission, launched in 2010, aimed to achieve 20 GW of solar capacity by 2022, later revised to 100 GW. The mission mandated domestically manufactured cells/modules, accelerating India’s solar manufacturing landscape. The mandated use of India-manufactured cells/modules in certain projects sparked a wave of new manufacturing plants across Gujarat, Tamil Nadu, and Andhra Pradesh, marking India’s transition from solar deployment to production.

3. Growth and Global Entry (2015–2019)

- Indian manufacturers, including Vikram Solar, Waaree Energies, and Adani Solar, increased their manufacturing capacity by nearly 10 GW by 2019, focusing on polycrystalline modules and increasing investment in monocrystalline technologies. This led to India becoming both a solar developer and hardware producer. Vikram Solar, established in 2005, launched module manufacturing in 2009, scaling to 500 MW by 2015 and expanding internationally. In February 2017, Tata Power Solar shipped over 1 GW of modules globally.

4. Strategic Policy Push & Capacity Ramp‑Up (2020–2023)

- India launched the Production Linked Incentive (PLI) scheme in 2021 to boost high-efficiency solar manufacturing, including modules, cells, and wafers. Tariffs like Basic Customs Duty and the Approved List of Models & Manufacturers (ALMM) protected and incentivized domestic industry. These policies led to a capacity doubling, with India producing approximately 6.6 GW of cells and 38 GW of modules by 2023. The policies addressed global supply chain issues and over-reliance on Chinese imports, resulting in domestic manufacturing surges and new entrants integrating backwards. India’s solar module capacity crossed 38 GW by 2023.

5. Rapid Scale and Technological Shift (2024–2025)

- India is preparing to become a global solar manufacturing hub, with several companies launching integrated gigafactories for polysilicon modules in Jamnagar, Gujarat. Adani Solar is expanding its value chain, while Emvee and Vikram Solar are investing in TOPCon and bifacial technologies. By 2025, India is expected to become the second-largest solar panel manufacturing hub globally, with module capacity exceeding 100 GW. Local manufacturers like Emvee have scaled aggressively, reaching 4.6 GW module capacity and adding 2.5 GW of high-efficacy TOPCon cell production by 2024. Reliance’s Jamnagar Giga Complex began its first phase in 2021.

Current Landscape of Solar Panel Manufacturing in India

1. Massive Capacity Expansion

India’s module and cell production capacity reached nearly 91 GW by the end of 2024, with Gujarat, Tamil Nadu, Rajasthan, and Karnataka being the leading states. UN estimates suggest module capacity will exceed 100 GW as PLI-supported projects come online, while cell capacity is set to surpass 50-55 GW by FY 2027. India added 25.3 GW of module and 11.6 GW of cell capacity, boosting total module output to approximately 90.9 GW and cell capacity to 25 GW+ by the end of the year. As of March 2025, module capacity surged from 38 GW to 74 GW, and cell capacity tripled from 9 GW to 25 GW.

2. Leading Hub States & Gigafactories

Gujarat leads in module capacity and cell output, with 42% of module capacity and 37% of cell capacity. Tamil Nadu hosts Tata Power’s new 4.3 GW integrated factory, while Sonipat hosts HVR Solar’s 2 GW N-type TOPCon bifacial plant. Maharashtra’s Butibori site produces 720 GW TOPCon modules, scaling from 1.5 GW to 7 GW by July 2025. Reliance’s Jamnagar Giga Complex targets 20 GW of modules with integrated cells and battery packs. Gujarat leads in module capacity and cell output, while Tamil Nadu hosts Tata Power’s 4.3 GW module-cell factory.

3. Key Players & Technology Trends

The technological split in solar energy is predominantly monocrystalline PERC (59%), with a 28% TOPCon capacity. Emerging HJT and large-format panels are becoming more common. Emvee Group has a 6.6 GW module capacity and a 2.5 GW TOPCon cell capacity, while Vikram Solar reaches 3.5 GW. Waaree is expanding its 5.4 GW cell plant and producing modules globally.

4. Government Policy Fueling Growth

The PLI Scheme, worth INR 24,000.0, supports around 48 GW of integrated modules and creates 11,650 jobs. The ALMM enforces over 64 GW of domestic module use in government projects. Adjusted import duties reduce raw material costs and protect domestic manufacturers.

Installed Manufacturing Capacity (2025 Estimates)

| Component Type | Installed Capacity (2025 Estimate) |

|---|---|

| Solar Module | ~90.9 GW (by end of 2024) |

| Solar Module | ~74 GW (as of March 2025) |

| Solar Cell | ~25 GW |

| Ingot-Wafer | ~2 GW |

| Target by 2030 | 160 GW module & 120 GW cell capacity |

Government Support & Policies Promoting Manufacturing

1. PLI Scheme (Production-Linked Incentive)

India has allocated ₹24,000 crore to boost GW-scale solar module production through a two-tiered initiative. The first tranche, awarded ₹4,500 crore in late 2021, aimed to increase capacity from 8.7 GW to 39.6 GW. The second tranche, approved in September 2022, aimed to increase capacity from 19,500 crore to 39.6 GW. The initiative aims to incentivize high-efficiency and integrated manufacturing, resulting in a surge in India’s solar module capacity from 2 GW to 70 GW in just 10 years.

2. Basic Customs Duty (BCD)

To strengthen India’s solar panel manufacturing ecosystem, the government introduced Basic Customs Duty (BCD) in April 2022—imposing 40% on solar modules and 25% on solar cells. This strategic move aimed to reduce import dependency and promote domestic solar panel manufacturing. In subsequent budgets, the BCD structure was slightly adjusted to ease access to upstream materials while still safeguarding local industries.

These measures have significantly enhanced the competitiveness of Indian-made products, giving a strong boost to solar panel manufacturing across the country. By limiting low-cost imports and incentivizing local production, India is paving the way for scalable and self-reliant solar panel manufacturing. As a result, solar panel manufacturing in India is not only expanding rapidly but also becoming more technologically advanced and globally competitive.

3. ALMM (Approved List of Models & Manufacturers)

The ALMM policy mandates solar projects from government schemes or DISCOMs to use Indian ALMM-listed manufacturers. As of 2025, 64.6 GW of module capacity is ALMM-approved, prioritizing domestic manufacturers for utility-scale and rooftop projects. Launched in 2022-2024, it ensures compliance and strengthens domestic supply.

4. Financial Support via IREDA

The Indian Renewable Energy Development Agency (IREDA) provides financial support for solar cell and module manufacturing projects, including long-term loans, soft interest rates, and custom-designed financial instruments for MSMEs and large-scale producers. With its “Navratna” status in 2024, IREDA’s capacity to support solar infrastructure is further strengthened.

Leading Solar Panel Manufacturers in India

Here are some of the key players driving solar panel manufacturing in India:

1. Soleos Solar Energy Private Limited

- Soleos is a leading solar panel supply company with a portfolio of over 450 MW commissioned and 160 projects completed. They specialize in high-quality solar panel supply for various applications, including rooftops, ground-mount systems, solar parks, carports, and agrivoltaics. Soleos is a turnkey partner offering EPC, module sourcing, and 25-year O&M.

2. Tata Power Solar

- Tata Power Solar, a pioneer in Indian solar manufacturing, has a 30+ year legacy and a manufacturing capacity of over 1.2 GW of modules and 4.3 GW of cells. The company is based in Bengaluru, Karnataka, and has a strong legacy in EPC expertise and government project experience. With a 4.3 GW cell-making plant in South India, Tata Power Solar is known for producing high-efficiency mono-PERC modules. The company’s Bangalore facility is among the most technologically advanced in the country.

3. Adani Solar

- Adani Solar, a subsidiary of Adani New Industries Ltd., is a prominent Indian solar manufacturing company with a capacity of 4 GW of modules and cells, with plans to expand to 10 GW by 2027. The company operates one of India’s largest integrated solar PV manufacturing plants, with in-house polysilicon and wafer manufacturing capabilities. Adani Solar is one of the few globally integrated solar manufacturers, ensuring quality and cost efficiency. The company operates a fully integrated plant from ingot to module, setting it apart from other solar manufacturing companies.

4. Waaree Energies

- Waaree Energies, a leading Indian solar manufacturing company, has a 12 GW capacity of modules and 5.4 GW of cells. Headquartered in Mumbai, it offers solar modules ranging from 10W to 600W. Recognized as a Tier-1 Bloomberg NEF manufacturer, Waaree leads in innovation and global reach. The company uses Mono-PERC, bifacial, and N-Type TOPCon technologies. With a large export footprint and PVEL recognition, Waaree is India’s largest solar module manufacturer.

5. Vikram Solar

- Indian manufacturer offers 3.5-4.5 GW modules with innovative HJT, n-type modules, Tier-1 and PVEL “Top Performer” technologies. Headquartered in Kolkata, they have planned cell capacity of 3 GW and offer high-quality export-ready modules.

The Supply Chain of Solar Panel Manufacturing in India

1. Raw Materials & Inputsials

- The key components of silicon-based solar cells include polysilicon, wafers, glass, encapsulants, backsheet, aluminum frames, and silver paste and junction boxes. India currently imports 100% of polysilicon and 80% of wafers, mainly from China and Southeast Asia, while solar glass, frames, and some encapsulants are manufactured locally. Companies like Borosil Renewables, RenewSys, and Visaka Group are expanding domestic production. The PLI Scheme incentivizes domestic manufacturing of wafers, ingots, and polysilicon.

2. Wafer to Cell to Module

- India’s wafer production is limited, relying heavily on imports. Adani, Vikram, and Waaree are setting up wafer lines under PLI Phase-II. Solar cell manufacturing is expected to reach 20 GW by 2025, using mono-PERC, TOPCon, and HJT technologies. Major players include Adani Solar, Waaree, Vikram Solar, Avaada, Tata Power, and RenewSys.

3. Solar Module Assembly

- India’s solar module manufacturing capacity is over 64 GW as of 2025, with major players like Waaree, Adani, Vikram, Emmvee, Rayzon, Goldi, and Soleos Solar offering high-wattage, ALMM-listed, and PVEL-certified modules. The assembly process includes cell tabbing, stringing, lamination, framing, junction box attachment, and flash testing.

4. Logistics & Distribution

- Solar panels are bulky and fragile, requiring careful handling in manufacturing hubs like Gujarat, Maharashtra, Tamil Nadu, and Karnataka. Challenges include port dependency and interstate logistics bottlenecks. Opportunities include dedicated solar parks and green corridors.

5. Soleos Solar’s Integrated Role in the Supply Chain

- Soleos Solar Energy is a leading EPC and solutions provider that plays a crucial role in the solar value chain. They partner with Tier-1 ALMM-approved panel manufacturers, manage BOS (balance of system), offer custom EPC solutions, and offer 25-year performance monitoring and asset management. With over 450 MW delivered and 160 projects completed, Soleos bridges solar manufacturing with end-user success, ensuring timely delivery, optimized performance, and cost-efficiency.

Challenges in Solar Panel Manufacturing in India

While the growth is promising, the industry also faces some key challenges:

1. Overdependence on Imports for Critical Raw Materials

India’s solar panel manufacturing sector, despite progress, heavily relies on imported components like polysilicon, wafers, silver paste, and specialized chemicals, making it highly sensitive to international price volatility, trade tensions, and currency fluctuations, unless robust upstream capacity is built.

2. Lack of Full Vertical Integration

India has made significant strides in module assembly, but the solar panel manufacturing value chain still lacks domestic wafer production, sufficient polysilicon refining, and seamless ingot-to-module integration. Most Indian manufacturers import intermediate products, limiting efficiency, quality control, and cost competitiveness.

3. Technological Gaps

India has made significant strides in module assembly, but the solar panel manufacturing value chain still lacks domestic wafer production, sufficient polysilicon refining, and seamless ingot-to-module integration. Most Indian manufacturers import intermediate products, limiting efficiency, quality control, and cost competitiveness.

4. High Capital Costs and Infrastructure Gaps

Solar panel manufacturing faces significant capital constraints due to high interest rates, expensive industrial land, and limited infrastructure in Tier-2 and Tier-3 regions, making it difficult for many units to scale without better financing access and industrial support.

5. Logistics Challenges

India faces challenges in transporting raw materials and modules, including high costs, congested ports, and customs clearance delays, impacting solar panel manufacturing timeline and profitability, particularly for export-focused players.

6. Global Competition and Price Pressures

Indian solar panel manufacturing companies face intense competition from Chinese and Southeast Asian firms, who operate on large scales, receive government subsidies, and offer aggressive global pricing, potentially causing them to struggle in international markets.

Role of Soleos Solar in India’s Manufacturing Ecosystem

Soleos Solar Energy is a key player in India’s solar panel manufacturing industry, serving as a bridge between Tier-1 manufacturers and large-scale deployments. They source high-efficiency modules from domestic manufacturers like Waaree, Adani, and Vikram, ensuring cost-optimization and regulation compliance. As a full EPC provider, Soleos oversees engineering, procurement, construction, and quality control. With logistics hubs across India and international reach, they facilitate seamless execution for rooftop, ground-mount, and solar park projects. They also integrate next-gen technology and provide 25-year O&M services with real-time SCADA monitoring.

Future of Solar Panel Manufacturing in India

India’s solar panel manufacturing industry is on the brink of transformation, driven by rising energy demand, government incentives, and a global push for clean energy independence. With a projected growth in manufacturing capacity of 100 GW by 2026, India’s solar module manufacturing capacity is expected to reach 55 GW or more. Companies like Adani Solar, Waaree Energies, Vikram Solar, Tata Power Solar, and Soleos Solar are at the forefront of this manufacturing boom. India’s next phase of solar manufacturing will be marked by a shift from conventional PERC modules to advanced technologies like n-type TOPCon, HJT, and bifacial solar panels.

Major manufacturers are scaling aggressively, with Adani Solar targeting 10 GW of integrated module and cell production, Waaree Energies commissioned a 12 GW plant, Vikram Solar and Tata Power Solar ramping up capacity with high-efficiency bifacial modules and smart manufacturing lines. India’s policy ecosystem strongly favors domestic solar panel manufacturing, with key enablers including the Production Linked Incentive Scheme, ALMM Mandate, Basic Customs Duty, and National Green Hydrogen Mission & Rooftop Solar Incentives.

Key Takeaways for Manufacturers and Industry Leaders

- India is Set to Become a Global Solar Manufacturing Powerhouse

With projected capacity reaching 100+ GW for modules and 55+ GW for solar cells by 2026, India is well on its way to becoming a major player in global solar panel manufacturing. - Advanced Technologies Are the Future

Manufacturers must pivot toward TOPCon, HJT, and bifacial modules to stay competitive. R&D in perovskite tandem cells and high-wattage modules (700+ Wp) will define the next wave of growth. - Policy Support is a Strong Tailwind

The PLI scheme, ALMM mandates, and BCD tariffs are boosting domestic manufacturing viability. Leveraging these policies is essential for long-term profitability and eligibility for government-backed projects. - Export Markets are Ripe for Expansion

With growing demand in the USA, Europe, MENA, and Africa, Indian manufacturers—especially those compliant with IEC standards—have an opportunity to capture significant global market share. - Vertical Integration is a Competitive Advantage

Investing in end-to-end production (from wafers to modules) ensures cost efficiency, quality control, and resilience against global supply chain shocks. - EPC and Supply Chain Partnerships Matter

Collaborating with EPC leaders like Soleos Solar, who bridge manufacturing and field execution, ensures smoother deployment, faster time to market, and optimized project performance. - Talent and Skilling are Critical

The shift to high-tech manufacturing requires a skilled workforce. Investing in training, automation, and process innovation is essential to support scale and quality. - Sustainability is a Differentiator

Manufacturers integrating green production practices, circular recycling programs, and lower carbon footprints will attract ESG-conscious investors and customers.

Conclusion: The Bright Future of Solar Panel Manufacturing in India

India’s solar panel manufacturing sector is poised for a promising future, driven by innovation, government support, and a commitment to sustainability. As the country aims for clean energy targets, solar panel manufacturing is becoming a crucial pillar in achieving energy independence, reducing carbon emissions, and positioning India as a global leader in renewable technology. Progressive policies like the Production Linked Incentive scheme, ALMM mandates, and Basic Customs Duty tariffs are empowering local manufacturers to scale operations, adopt advanced technologies, and strengthen the solar supply chain.

Companies like Adani Solar, Waaree Energies, Vikram Solar, and Soleos Solar are redefining the landscape of solar panel manufacturing in India, enhancing the quality and reliability of solar modules while contributing to India’s capability to serve both domestic and international markets. Despite challenges like raw material imports, logistics constraints, and skill shortages, the sector continues to grow, supported by consistent policy support and increasing investments in research and development. With rising global demand for clean energy technologies, India has the opportunity to become a global exporter of high-efficiency, cost-effective solar solutions. With the right mix of technology, talent, and policy, India is on course to lead the world in solar panel manufacturing, powering progress for generations to come.

FAQs

1. What is solar panel manufacturing, and why is it important in India?

Solar panel manufacturing refers to the process of producing photovoltaic (PV) panels, which convert sunlight into electricity. In India, this sector is crucial to reducing reliance on imports, achieving clean energy goals, creating jobs, and establishing the country as a global renewable energy hub.

2. Who are the leading solar panel manufacturers in India?

India hosts several prominent manufacturers, including Waaree Energies, Adani Solar, Vikram Solar, Tata Power Solar, RenewSys, Emmvee, and Soleos Solar, each contributing significantly to India’s solar manufacturing capacity and technological advancement.

3. What technologies are used in solar panel manufacturing in India?

Indian manufacturers are transitioning from traditional mono PERC to advanced technologies such as TOPCon (Tunnel Oxide Passivated Contact), HJT (Heterojunction Technology), bifacial modules, and perovskite tandem cells, aimed at improving efficiency and output.

4. What is the current manufacturing capacity for solar panels in India?

As of 2025 estimates, India’s solar panel manufacturing capacity exceeds 100 GW for modules and 55 GW for cells, with major expansions underway under the PLI (Production Linked Incentive) scheme.

5. How is the Indian government supporting solar panel manufacturing?

The Indian government has introduced several initiatives, including:

- PLI Scheme to incentivize capacity additions and technology upgrades

- ALMM (Approved List of Models and Manufacturers) compliance for public projects

- 25%–40% BCD tariffs to reduce cheap imports and promote local production

- Subsidies for rooftop solar, indirectly boosting domestic demand

6. Is India exporting solar panels to other countries?

Yes. Indian solar panel manufacturers are increasingly exporting to the USA, Europe, Middle East, and Africa. With rising global demand and the “China+1” sourcing strategy, India is emerging as a reliable exporter of quality solar modules.

7. What role does Soleos Solar play in the manufacturing ecosystem?

Soleos Solar acts as a critical bridge between solar panel manufacturing and real-world deployment. While not a primary manufacturer, Soleos partners with ALMM-listed brands to source high-quality panels, integrating them into turnkey EPC solutions for industrial, commercial, and utility-scale projects across India and abroad.

8. What are the major challenges in solar panel manufacturing in India?

Key challenges include:

- Dependence on imported raw materials like polysilicon and wafers

- High capital investment required for upstream integration

- Skill shortages in advanced manufacturing and R&D

- Logistics and infrastructure limitations in remote areas

9. What are the future trends in solar panel manufacturing in India?

The future is geared toward:

- Advanced cell technologies (TOPCon, HJT, perovskite)

- Fully integrated supply chains (from polysilicon to modules)

- Digital manufacturing and AI-driven QC

- Sustainable and recyclable modules to support ESG goals

- Export growth with compliance to international standards (IEC, UL, etc.)

10. How can manufacturers or EPC companies partner with Soleos Solar?

Manufacturers and EPC providers can collaborate with Soleos Solar for:

- Module procurement aligned with ALMM/PLI policies

- Turnkey EPC execution across C&I, utility, and solar park projects

- Long-term O&M and digital asset management

- Market entry support in global regions including the UAE, UK, Kenya, and Spain